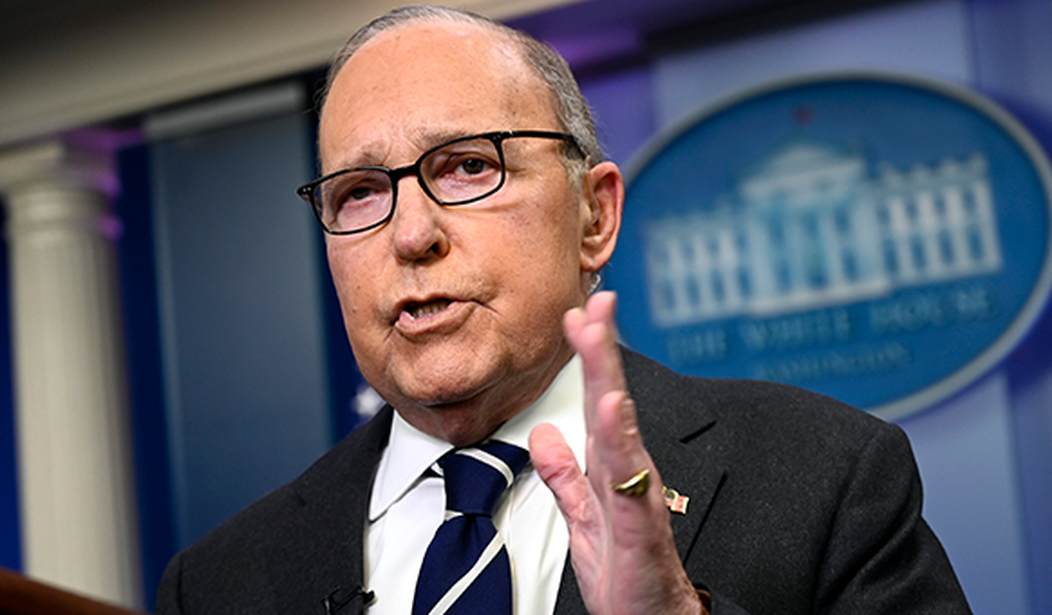

I have to say, yesterday was an impressive session. There was every reason to send the market significantly lower with a series of headlines that would have hammered major indices much more back in December. The Dow opened lower, plunged and then rebounded into the close. Larry Kudlow, White House economic advisor, suggested the trade deal was long way off, and there will be no meeting before scheduled hike in tariffs.

- Dow Opened 25,265 -125

- Kudlow Comments 25,193 -197

- No Meeting 25,000 -390

Today, the market is looking to open lower. Again, I will be watching to see the action around Dow 25,000, which was a key resistance number and is now trying to establish a base of support.

I think the White House needs to adjust the tariff hike deadline, but understand, doing so too soon would be a sign of weakness. Moreover, reports the administration is prepared to take tougher action against major Chinese telecom companies are sure to complicate the issue, but it shouldn’t derail the progress or an eventual deal.

Portfolio Approach

We sent alert yesterday suggesting subscriber take profits on Match.com (MTCH), which we had in Technology (not sure it shouldn’t have been in Communication Services). We think investors should still have exposure to Technology, where there are two bold ideas. For more help, please reach out to your representative or research@wstreet.com. If you are not a current subscriber to our Hotline, click here to get started today.

Recommended

Communication Services 2 | Consumer Discretionary 3 | Consumer Staples 1 |

Energy 1 | Financials 1 | Healthcare 1 |

Industrial 4 | Materials 4 | Real Estate 0 |

Technology 1 | Utilities 0 | Cash 2 |

Join the conversation as a VIP Member