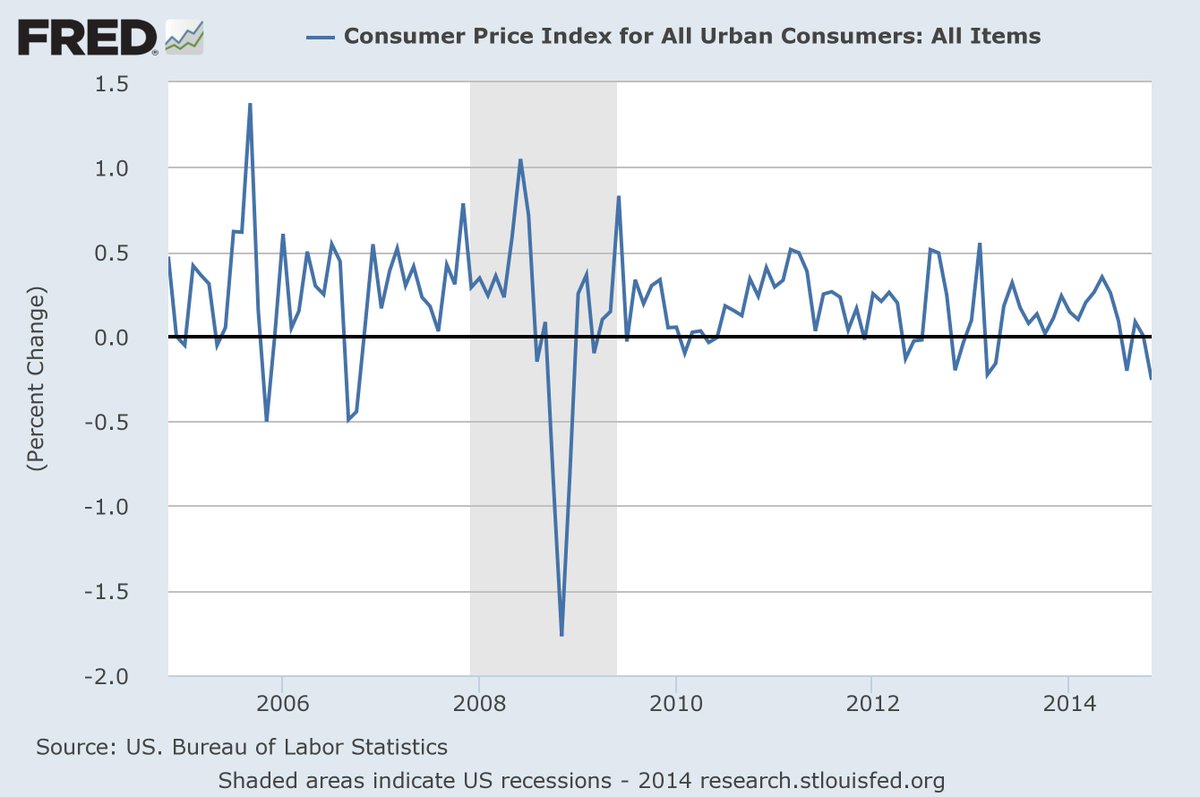

Could we be entering into a golden period where inflation is not only not an issue, but prices are falling in so many key areas of day to day life that it amplifies income even though wages aren't rising?

The short answer is “yes,” and it's what the Fed has been working toward for years. The other question is “has this reward been worth the risk?”

That answer remains to be seen. Critics, including myself, frown upon the way money printing makes the dollar weak and eventually leads to major inflation. But, today the dollar is strong and prices are in free fall. It's not just crude, but things like apparel and used cars. Only electricity, which the White House warned would necessarily move higher as a consequence of killing the coal industry, is still edging higher. And while plenty of homemakers will point to things like higher beef prices, it's hard to deny cheap gas and other things aren't having an impact.

Last month, consumers spent money faster than they earned it and dipped into savings to make it happen. Blind confidence? Certainly it’s disturbing, but it's what the architects of money printing have been seeking.

I'm only going to remind everyone there is a threat of deflation even as the dynamics of oil and gasoline used has changed from the past. We aren't going to base any investments on it because I'm not sure it's different this time, but right now it looks different.

Recommended

Right now, we're basing investment strategy on this window in time a burgeoning golden period that needs one key ingredient of higher wages to move into the next level. Maybe we dodge deflation and later in 2015, the worry is too much money is chasing too few goods. In such a scenario, it feels real good and lots of money can be made in the market. For those that think Fed policy got the market to this level- wait until it goes into overdrive and the S&P is trading at a PE of 23 or more.

So, we ride the wave for now and into 2015.

Join the conversation as a VIP Member