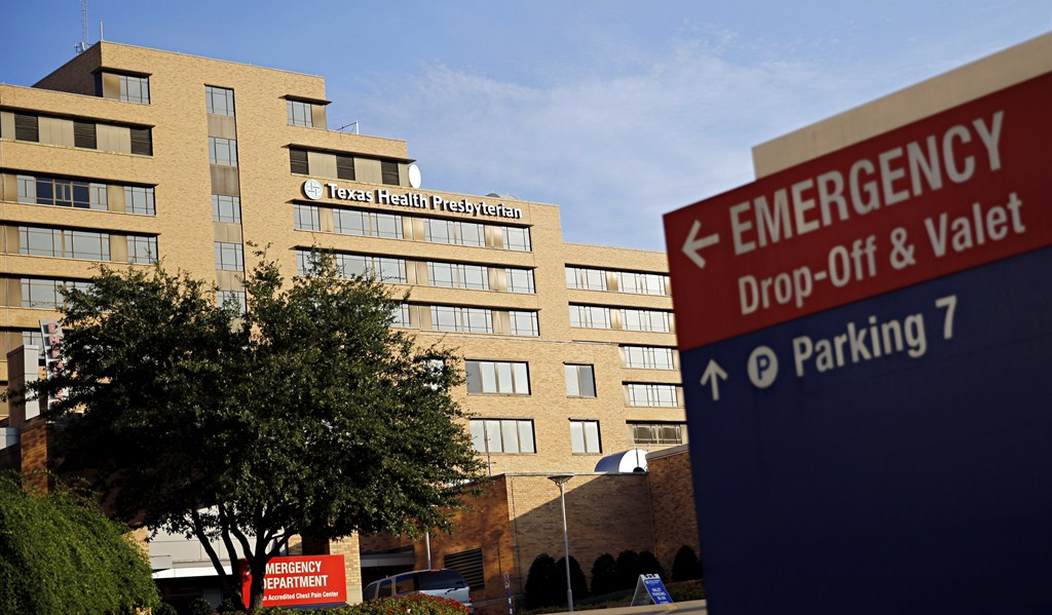

Late yesterday, the Centers for Disease Control and Prevention (CDC) reported the first case of Ebola in America. Officials stressed the virus will be contained, but this is the kind of stuff that nightmares are made of. While I do not expect panic thanks to containment, it is worrisome that the American passenger did not exhibit any symptoms of Ebola until four days after his flight from Liberia to Texas on September 20th, and he was not hospitalized until September 28th. In addition to near-term pressure on airlines and multiple spikes in pharmaceutical names (most will crash later), several ethical issues will arise.

The notion of screening people coming into this country has to be discussed. Looking back at how the Plague in Europe was addressed, we learn that Venetians made ships dock for ‘forty days’ before passengers could come ashore. The word “quarantine” originated from the Venetian dialect “quaranta,” meaning “forty days.” Last week, the CDC said left unchecked, the Ebola virus could grow to 1.4 million cases by end of January. I am confident that we can contain it in America, but people are going to be afraid for a long time. I would not make any stock market decisions based on this news.

Activists Always Win

On Friday, Starboard publicly pushed Yahoo’s management to make decisive moves including, acquiring AOL. The move sets up drama that encompasses several of the biggest topics on Wall Street, and even Main Street where investing buckets of cash is a problem for large corporations, even with US companies sitting on $1.7 trillion. It is now a huge question mark for Yahoo, too.

$9.5 billion cash IPO

$37.0 billion 16.5% stake

$40.5 billion market cap

Then, there is the role of activists investors whom I lovingly call the ‘Pharaohs of Wall Street.’ These guys are making tons of money for themselves and investors, but most never change their corporate behavior or get seats on the board of directors for companies.

Recommended

| Activist or Shakedown Artists? | |||

| 10 years of Activism | Board Battles | Seat Concessions | Duration(months) |

| Ackman | 22 | 5 | 14 |

| Einhorn | 15 | 1 | 25 |

| Icahn | 65 | 26 | 26 |

| Loeb | 28 | 7 | 13 |

| Peltz | 15 | 5 | 29 |

| Rosenstein | 25 | 5 | 20 |

| Singer | 28 | 4 | 33 |

| Smith (Starboard) | 69 | 35 | 16 |

| Ubben | 13 | 5 | 22 |

| Whitworth | 28 | 8 | 23 |

While takeovers inject life into the market, many of these activist deals result in something that adds value to their targets, but not in the same way as an acquisition. So, a board market impact from activism, even in huge household names would have a limited impact on the broad market.

Hong Kong, Not Arab Spring

Why the protest in Hong Kong is not the new Arab Spring, is to look at this picture from the Wall Street Journal Asia. Look closely at the advertisement on the exterior wall of the mall. Piaget watches are the crème of the crop in luxury brands beginning at $15,000, up to $70,000 with diamond encrusted models priced upon request.

I get the idea that everyone wants universal suffrage, and in this case, it was promised, but there is an element of the Occupy movement in these protests, which saw college kids and young adults frustrated in the midst of an economic slowdown. Despite the obvious frustration of young adults in Hong Kong, they have got it good versus most of the world, particularly with their unemployment rate. The city-state’s per capita income of $38,124 is more than ten times that of Egypt.

| Unemployment Rate 15 – 24 year olds | |

| Globally | 12.6% |

| Hong Kong | 9.4% |

| Egypt | 24.8% |

There is a lot at stake, even with Hong Kong representing 2.5% of China’s GDP from the 16.5% when it was handed over by the United Kingdom. Moreover, I suspect this movement will fizzle out much like the Occupy movement in America.

Join the conversation as a VIP Member