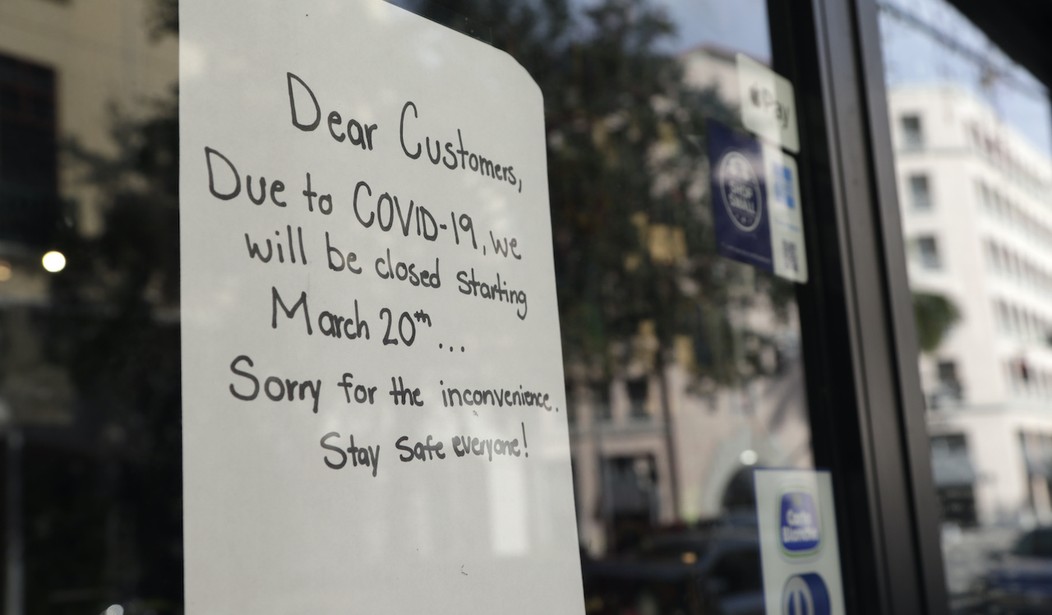

The massive economic destruction being wrought by the COVID-19 epidemic and the government's attempt to mitigate the impact on American families and businesses raises a fundamental question: is the sum total of America's greatness measured by its markets or by its people?

Americans have served the world, and particularly the developing world, as the largest consumers of goods and services of any nation on earth. Entire civilizations have risen from the dust -- notably China -- on the back of the American consumer. In return for opening its markets to foreign goods and services, America has been able to consistently borrow money from abroad to finance its insatiable appetite for more stuff. Most Americans, in fact, equate consumerism with the American way of life.

To put the notion of America as a market in some historical perspective, it bears mentioning that today's America started out as a group of mercantile colonies of England, France, the Netherlands and Spain. Traders, in search of foreign markets for resources and labor engaged in a triangular trade for slaves, sugar and rum -- as well as textiles, spices and other staples of the time. The mercantile class became so successful in colonial-era Europe, in fact, that they ultimately supplanted the royal classes in both wealth and power. Modern America and modern Europe are the direct results of the rise of global commerce.

Over the past decades, American politicians have declared that "free markets" are synonymous with "freedom." In fact, the two have become so intermingled in the American lexicon, that one tends to conflate capitalism with democracy. Both the Republican and Democratic parties alike championed "free trade" as a global wealth builder, with America's free markets leading the way.

Recommended

But there has been a growing disconnect between the notion of nation and markets. Donald Trump's election marks the first time in over a generation that a Republican president has urged trade protectionism rather than global expansion as a cure for stagnant domestic growth. To many, Trump's call to close the borders and cut off trade seemed weirdly alarmist given America's interdependence with both its immediate neighbors, notably Mexico, and its distant trading partners, notably China.

As if to further illustrate the problem with confusing capitalism with democracy, China has become increasingly more capitalist over the past 30 years, while also becoming increasingly autocratic. When President Nixon initiated the Cold War detente with China, his primary aim was to reduce the Soviet Union's influence on Asia. But in opening up relations with the world's most populous country, he was also seeking markets for America's goods and services, assuming that trade between China and the U.S. would be free and fair. However, China has proven to be a tough market for U.S. businesses to enter, while on the contrary, the U.S. is flooded with Chinese goods --including those most critical during the COVID crisis, medicine and medical supplies.

While America became the world's largest consumer, China became its largest producer. In 2002, China's middle class constituted a mere 4 percent of its population. In 2020, more than 30 percent of its citizens -- some 420 million people -- enjoy middle-class incomes. Over the same time period, America's middle class has declined. Real wages in the U.S. have stagnated, labor force participation contracted, and the wealth gap has widened to the largest it has ever been.

While it is convenient to blame China's predation for America's woes, the real culprits lie much closer to home. Americans consume far more than we produce and because we have the world's biggest credit card -- dollar-backed U.S. treasuries -- we have believed that we could consume our way out of persistent economic stagnation. This has proven to be a false narrative and the chickens are finally coming home to roost.

As the U.S. government prepares to take on massive amounts of debt to try and stave off the economic consequences of the COVID-19 pandemic, the problem becomes even more stark. That debt is not being taken on to fund productive projects -- such as sorely needed national infrastructure. Nor is it being invested in plants and equipment that fuel industrial production. Rather, it is being placed directly in the hands of the consumer, who is being urged to go out and spend their newly minted government cash on -- you guessed it -- imported goods that have been produced in China and other foreign nations.

If this state of affairs seems counterintuitive, and perhaps counterproductive, that's because it is. Americans might be far better off if instead of trying to spend our way out of a looming recession we attempted to revive our productive capacity and work our way out. It will take time to do this, but if we can manage to secure just a modicum of the self-initiative and industriousness that made our nation great in the first place, it will be well worth the sacrifice. Just ask the Chinese.

Join the conversation as a VIP Member