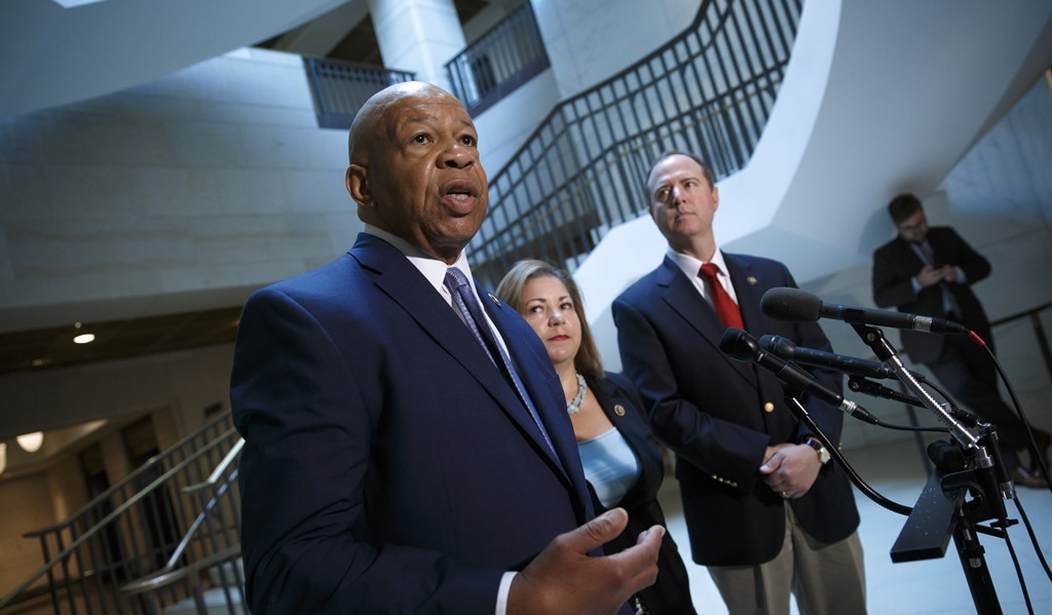

Democrats are still finding ways to demonize their Republican colleagues' Tax Cuts and Jobs Act, which has been growing in popularity since its inception in December. The bill has led to thousands of employee bonuses and salary raises. But, Rep. Elijah Cummings (D-MD) has a new report out highlighting a new angle. He's out to prove that the tax law hurts homeowners while unfairly benefiting real estate developers.

The report points out that the tax law limits the deduction for interest on home-equity loans, meaning taxpayers will only be able to claim the deduction if they use the loan proceeds for home improvements. It also places a $10,000 cap on the state and local tax deduction, which would affect roughly 12 million homeowners.

"Although some may reap large financial windfalls as a result of the changes in the new tax law, many American families will be penalized despite their ongoing efforts to faithfully invest in their single biggest asset - their home," Cummings's team wrote.

He uses recent statistics from the Joint Committee on Taxation as proof. In its analysis on the Republican tax bill, the JCT estimated that its tax breaks for real estate developers will lead to $66.7 billion in lost federal revenue over a decade.

“Republicans in Congress punished middle-class American homeowners while lavishing tens of billions of dollars in tax breaks on wealthy real estate developers like President Trump and his rich friends," Cummings concluded in a statement.

Recommended

It seems the dueling narratives about the GOP tax reform is heating up again as we head toward the midterms. Will House Minority Leader Nancy Pelosi again start using the word "crumbs" to describe the tax reform bonuses that have reached about 3 million employees? Not if she's smart. Even her Democratic colleagues cringed at those choice in words.

Also, how do they spin this.

Join the conversation as a VIP Member