The data is in for April. Here's what happened:

1. Household personal income (inflation adjusted) rose, but every penny -- and then some -- went into savings or paying down debts. Consumer spending, on which Barack Obama is betting to stimulate the economy, actually fell. None of the stimulus money was sent. None.

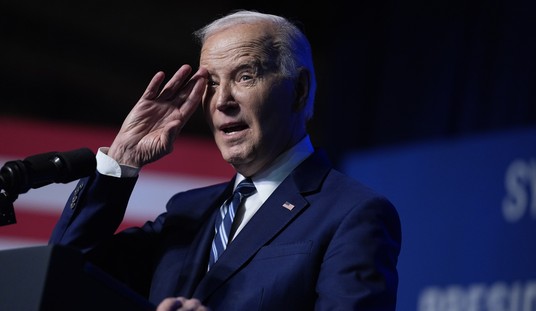

2. Meanwhile, to pay for this stimulus spending that didn't stimulate, Obama had to borrow so much money that long-term interest rates have almost doubled since he took office, forcing postponement or abandonment of business expansion and hiring across the board.

What a record!

Here are the details. In April, personal household, inflation-adjusted income rose by $122 billion. Of that increase, one-third -- or $44 billion -- came from the government's stimulus program. But while personal income was rising, household savings (which includes paying down credit-card balances, mortgages, student loans, car loans, etc.) rose by $132 billion -- $10 billion more than the rise in income. So personal consumption dropped 0.1 percent.

The stimulus package was a total and complete failure. As predicted, as happened with Bush's 2008 tax cut, as happened with the Japanese stimulus packages of the '90s, fearful consumers sat on their money and wouldn't spend it. Keynesian economics didn't work. Again.

But the debt sure piled up. The deficit quadrupled and is sending interest rates soaring, as the government elbows aside businesses and consumers at the loan window, all in a desperate effort to borrow enough money to spend enough money to stimulate the economy, which isn't happening.

Recommended

Keynesian economics doesn't work. The theory for rational expectations has taken its place. Consumers are not idiots. They know that when their paycheck is fatter -- either because of tax cuts or government spending -- that it is not the beginning of Nirvana, but just a short-term, one-shot respite from hard times. They know the difference between standing in front of an electric fan and a windy day.

Barack Obama has fatally undermined our currency, our solvency, our financial stability and -- ultimately -- our economy, all to spend money that has had no economic effect!

Is Obama a failure? Not by his lights. His goal was never to stimulate the economy. His goal was to expand government spending, and he used the recession as an excuse to do so. And, by this standard, he is a raging success. With the stimulus spending, the government proportion of gross domestic product will rise from about 35 percent to about 40 percent, and with health care "reform" it will go soaring into the mid-40s, bringing us to parity with Germany en route to France!

But the results are in: None of Obama's spending is doing anything to help the economy.

Of course, the process of household savings, designed to pay down debt, is very healthy.

Economists call it de-leveraging. By the start of the recession, the debt American households owe had risen from 70 percent of their annual income in 1995 to 140 percent (excluding mortgages). Now it's on its way back down again. And, eventually, that will lead to a real recovery -- if Obama doesn't wreck the currency and bring on mega-inflation before then (but he probably will).

Join the conversation as a VIP Member