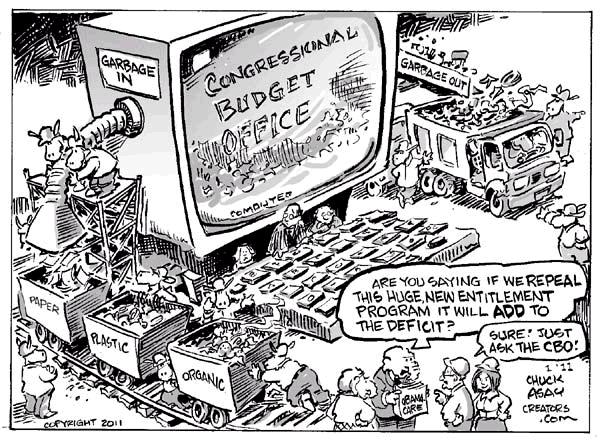

Since I’ve accused the Congressional Budget Office of “witch doctor economics and gypsy forecasting,” it’s obvious I’m not a big fan of the organization’s approach to fiscal analysis.

I’ve even argued that Republicans shouldn’t cite CBO when the bureaucrats reach correct conclusions on policy (at least when such findings are based on bad Keynesian methodology).

I’ve even argued that Republicans shouldn’t cite CBO when the bureaucrats reach correct conclusions on policy (at least when such findings are based on bad Keynesian methodology).

So nobody should be surprised that I think the incoming Republican majority should install new leadership at CBO (and the Joint Committee on Taxation as well).

So why, then, are some advocates of smaller government – such as Greg Mankiw,Keith Hennessey, Alan Viard, and Michael Strain – arguing that Republicans should keep the current Director, Doug Elmendorf, who was appointed by the Democrats back in 2009?

Before answering that question, let’s look at some of what was written today for theWashington Post’s Wonkblog.

After a series of highly-regarded conservatives voiced their support for Doug Elmendorf, the director of the Congressional Budget Office whose term is up in January, Elmendorf haters fired back on Friday, urging Republicans to jettison the Democratic appointee as soon as possible. …This argument is advanced most forcefully in an open letter to GOP congressional leaders by Grover Norquist of Americans for Tax Reform, who…is most famous as the author of the anti-tax pledge that binds virtually every Republican in Congress never to vote to raise taxes. So why is Norquist against Elmendorf? For one thing, because CBO, under Elmendorf, has not demonized higher taxes.Instead, the agency promotes a “Failed Keynesian Economic Analysis,” Norquist says, that asserts that “higher taxes are good for the economy, even to the point of implying that growth is maximized when tax rates are 100 percent.”

Recommended

And where did Grover get the idea that CBO believes that ever-higher taxes lead to more growth?

Umm…well, from something I wrote.

As evidence,Norquist points to a 2010 post by the Cato Institute’s Dan Mitchell, titled “Congressional Budget Office Says We Can Maximize Long-Run Economic Output with 100 Percent Tax Rates.” “I hope the title of this post is an exaggeration,” Mitchell writes, “but it’s certainly a logical conclusion based on” CBO’s claim that paying down the national debt — regardless of whether it’s through higher taxes or lower government spending — would be a good thing for the economy. “There’s nothing necessarily wrong with CBO’s concern about deficits,” Mitchell goes on. But “what’s missing from CBO’s analysis is any recognition or understanding that the real problem is excessive government spending.” In other words, what’s missing is conservative ideology about fiscal policy.

I have two reactions, one minor and one major.

My minor point is that the author of the piece is supposed to be a neutral, even-handed reporter, yet she refers to opponents of Elmendorf as “haters” and she implies that we’re simply upset because CBO’s analysis is missing “conservative ideology about fiscal policy.” Given that she was writing for Wonkblog, which is more akin to an editorial page, there’s nothing wrong with being opinionated. But ask yourself whether someone with such hostility can be impartial when doing straight news stories.

My major point is about policy. Why is my concern about the size of government characterized as “ideology” while we’re supposed to believe CBO’s analysis is “scrupulously impartial” even though it produced analysis which implies you maximize growth with 100 percent tax rates?!?

If my views are blind ideology, then why is there research showing the economic damage of excessive government from international bureaucracies such as theWorld Bank and European Central Bank? And why are there studies about the harmful economic impact of government spending from the International Monetary Fund and the Organization for Economic Cooperation and Development? Nobody has ever accused these institutions of being hotbeds of libertarian thought.

But perhaps I’m not being fair to CBO. Did the bureaucrats really imply, as part of their analysis on what would happen to the economy if the Bush tax cuts were allowed to expire, that you maximize growth with 100 percent tax rates?

You can read my original post, which holds up very well four years later. And here’s some of what I wrote yesterday to someone who asked me to justify my views on the issue.

…let’s focus on the “subsequent years,” when CBO projectst that GDP would be lower with extended tax cuts. …I’m happy to be corrected, but my reading is that CBO was stating that fiscal balance is the tail that wags the economic dog. The extended tax cuts cause larger deficits, and CBO says that these larger deficits will divert national saving from productive investment and lead to lower output. But if the tax burden is higher, as in the baseline forecast, then deficits are lower and more saving is available for productive investment and output is higher. As far as I’m aware, CBO didn’t have any limiting language back then to suggest that higher tax rates led to growth, but only up to X point. So I think I was on solid ground in asserting the CBO’s analysis implied that ever-higher tax rates led to ever-higher growth.

Seems reasonable. Moreover, I strongly suspect the Wonkblog reporter would have found several people to condemn me had I over-stated the implications of CBO’s analysis.

Now let’s return to the issue of whether Mr. Elmendorf should be re-appointed. Which fiscal conservatives are correct, the ones who want to keep him or the ones who want him replaced?

I’m in the latter category, as explained here, but Elmendorf’s defenders make plenty of good points.

The bottom line is that he is a nice guy (based on my limited interactions), a thoughtful economist, and he has been a big improvement over his predecessor. Indeed, he’s almost certainly the best CBO Director ever appointed by Democrats.

Here’s an analogy that may help make sense of this issue. Elmendorf’s predecessor was a doctrinaire leftist named Peter Orszag. If Orszag’s policy views were a country, they would be France or Greece. By contrast, I’m guessing that Elmendorf would be like Sweden orGermany.

Here’s an analogy that may help make sense of this issue. Elmendorf’s predecessor was a doctrinaire leftist named Peter Orszag. If Orszag’s policy views were a country, they would be France or Greece. By contrast, I’m guessing that Elmendorf would be like Sweden orGermany.

In other words, he wants more government than I do, but at least Elmendorf basically understands that there’s no such thing as a free lunch. He realizes 2+2=4, and he’s aware that there are tradeoffs. And since his arrival, CBO has been much better on issues such as the adverse impact of higher marginal tax rates and thedebilitating effect of higher transfer payments.

That being said, while it’s much better to be Sweden rather than Greece, I obviously would prefer to be Hong Kong (or, even better, pre-1913 America).

Though, to continue the analogy, the best I can probably hope for is that Republicans appoint someone akin to Australia or Switzerland.

P.S. For more information about the economics of deficits and fiscal balance, here’sa video I narrated for the Center for Freedom and Prosperity.

P.P.S. The Congressional Research Service made the same argument about higher taxes being pro-growth, asserting in 2010 that “The expiration of the tax cuts would nevertheless reduce the budget deficit, absent other policy changes, which economic theory predicts would have a positive effect on the economy in the long run.”

Join the conversation as a VIP Member