I’ve already written about how the Paris-based Organization for Economic Cooperation and Development (OECD), which is heavily subsidized by American taxpayers, is advocating for bigger government.

I’m especially irked that the OECD has gotten in bed with nutjobs from the Occupy movement and also joined forces with the union bosses to push for statist policies.

So I guess I shouldn’t be surprised that the bureaucrats are now acting as cheerleaders for Thomas Piketty and class-warfare tax policy.

This is evident in a new report on “Top Incomes and Taxation in OECD Countries.” The bias is evident on the very first page, with the report asserting that “the very richest in society are accumulating an ever-increasing proportion of national incomes.” Yet this language inaccurately implies the economic pie is fixed in size and it is rather revealing that it uses “accumulating” rather than “earning.”

But that’s trivial compared to the assertion, also on the opening page, that the goal is to “identify concrete policy options to ensure a fairer distribution of resources.” In other words, the focus is on re-slicing the pie, not making it bigger.

But the problem is not merely bad rhetoric. The report concludes with a long list of potential tax hikes, all of which supposedly are justified because “historically high levels and the sustained rise in the share of top income recipients in total income are often taken as signs that top earners’ “capacity to pay” tax has increased. Furthermore, this coincides with a period where public finances are tight and governments are seeking new sources of revenue.”

Recommended

I guess we shouldn’t be surprised that a bureaucracy representing governments has a list of policies designed to increase government power. But that doesn’t change the fact that class-warfare policies are destructive.

The OECD lists a smorgasbord of tax hikes, beginning with higher top tax rates.

A most direct way to ensure that top income earners pay a higher share of taxes is to raise marginal tax rates on income as well as other taxes which affect them. While there may be some concerns that such measures may not be as effective as intended with regard to raising tax revenues, some recent analysis suggests that there is still some scope to increase top tax rates to maximise tax revenues.

I supposed I should be happy that the bureaucrats are at least acknowledging that higher tax rates may not be “effective” because of Laffer Curve reasons, but it’s nonetheless disturbing that they think the goal should be revenue maximization.

That implies imposing a lot of economic damage to collect very small amounts of revenue. As Professor Martin Feldstein observed:

Why look for the rate that maximizes revenue? As the tax rate rises, the “deadweight loss” (real loss to the economy rises) so as the rate gets close to maximizing revenue the loss to the economy exceeds the gain in revenue…. I dislike budget deficits as much as anyone else. But would I really want to give up say $1 billion of GDP in order to reduce the deficit by $100 million? No. National income is a goal in itself. That is what drives consumption and our standard of living.

Looking specifically at an Obama proposal to boost payroll tax rates, Lawrence Lindsey admitted that the government would get more money, but at very high cost.

We should also keep in mind that the economic well-being of the country is not measured by how much taxes the government can collect, or even the size of the deficit. Rather, it is measured by the country’s productive capacity. …It is shocking to think that we have a presidential candidate who would make the private sector $5 poorer in order to make the government $1 richer.

And here’s what I wrote about some research from the European Central Bank.

…this study implies that the government would reduce private-sector taxable income by about $20 for every $1 of new tax revenue. Does that seem like good public policy? Ask yourself what sort of politicians are willing to destroy so much private sector output to get their greedy paws on a bit more revenue.

Here’s the remaining list of suggested tax hikes, followed by my parenthetical observations.

By the way, there’s one group that doesn’t have to worry very much about all these proposed tax hikes. OECD bureaucrats get tax-free salaries, which may explain why they seem oblivious to the real-world impact of their proposed policies.

Interestingly, the report inadvertently acknowledges that lower tax rates are good for capital formation and tax compliance.

The decline in top rates of income tax leads to a reduction in the tax burden carried by high earners and thus increases their post-tax income. Higher disposable income makes it easier for individuals to save and accumulate capital which eventually increases incomes further. Reducing top rates of income tax reduces the incentive to engage in tax planning to avoid or evade tax, so leads to more income being declared for income tax purposes.

Though this accidental bit of insight certainly didn’t have any impact on the OECD’s policy recommendations.

P.S. I periodically cite data from the IMF, BIS, and OECD to show that rising burdens of government spending are sewing the seeds of fiscal crisis in most industrialized nations.

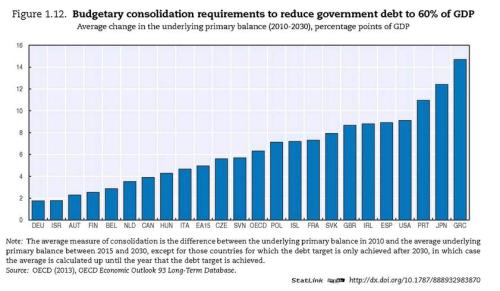

We now have updated numbers from the OECD. The good news, so to speak, that America’s need for “budgetary consolidation” appears to have dropped from about 9.5 percent of GDP to 9 percent of GDP. But we’re still one of nations with the biggest long-run challenge, which is why I’m a broken record on the need for real entitlement reform.

The numbers for Greece and Portugal have gotten much worse in the past couple of years. I’m tempted to say that this is evidence that all the tax increases in those two nations have backfired. But I suspect it’s more a function of the OECD statistics people being wildly off base a couple of years ago.

P.P.S. If you were asked about the policies needed to promote more growth in Malaysia and Indonesia, you would probably suggest copying the high-growth economies in the region such as Hong Kong and Singapore.

But if you were an OECD bureaucrat, you would instead put out a report about “Rising tax revenues: A key to economic development in emerging Asian countries.”

And you would make this absurd assertion.

Increased domestic resource mobilisation is widely accepted as crucial for countries to successfully meet the challenges of development and achieve higher living standards for their people. Additional tax revenues enable governments to simultaneously strengthen infrastructure development, enhance the quality of education and promote social cohesion.

But don’t be surprised. The OECD made the exact same recommendation for higher taxes to finance bigger government when looking at Latin American economies. So at least they’re consistent.

Too bad the OECD bureaucrats are so in love with higher taxes that they never suggest the policies that enabled Western Europe to become rich.

P.P.P.S. The OECD report focuses on “taxing the rich,” but always remember that politicians use that as a strategic gimmick in order to justify higher taxes on the rest of us.

Join the conversation as a VIP Member