The Internal Revenue Service plans to hire at least 30,000 additional agents over the next two years, spending about $80 billion on new technology that the Biden Administration will fund.

The multi-billion investment from President Joe Biden’s Inflation Reduction Act will improve tax enforcement and provide “world-class” customer service.

According to the 148-page Strategic Operating Plan, the federal agency will allocate roughly $8.64 billion toward the fiscal years 2023 and 2024. The plan also states that 8,782 of the newly recruited employees will be designated as enforcement staff during this time. As a result, by the end of 2024, the IRS will have grown its workforce to nearly 100,000 employees.

“The IRS is going to hire more data scientists than they ever have for enforcement purposes,” U.S. Deputy Treasury Secretary Wally Adeyemo told reporters, adding that this will make more traditional tax attorneys more efficient by using revenue agents in using new data analytics technology to identify audit targets.

A Treasury official said its goal is to help close the “tax gap” between taxes owed and those already paid by focusing new audits on the wealthiest Americans.

However, several Republicans are not on board with IRS agents harassing Americans.

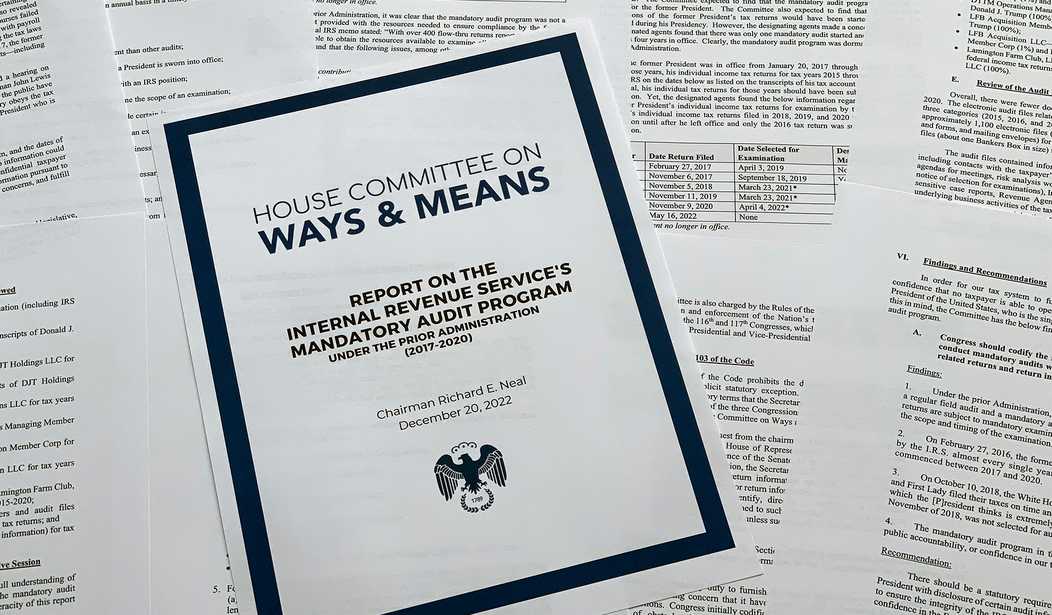

Rep. Adrian Smith (R-Neb) of the Ways and Means Committee accuses the Biden Administration of targeting small business owners and hard-working Americans.

Recommended

“This spending plan is too little, too late. Treasury blew through their February 17th deadline to release this plan, which shows how unserious they are about assuring American families and small businesses they won’t be targeted under the $80 billion tax enforcement scheme in the Inflation Act,” Smith said.

Sen. Steve Daines (R-Mont) also criticized the agency’s plan saying the IRS wants “to deploy an army of tens of thousands of IRS agents to increase audits on Montana families and reach into the pocketbooks of Americans.”

New IRS Commissioner Danny Werfel, however, attempted to downplay Republicans’ worries saying said that the percentage of Criminal Investigation staff would not change from its current proportion of about 3 percent of the IRS workforce.

Join the conversation as a VIP Member