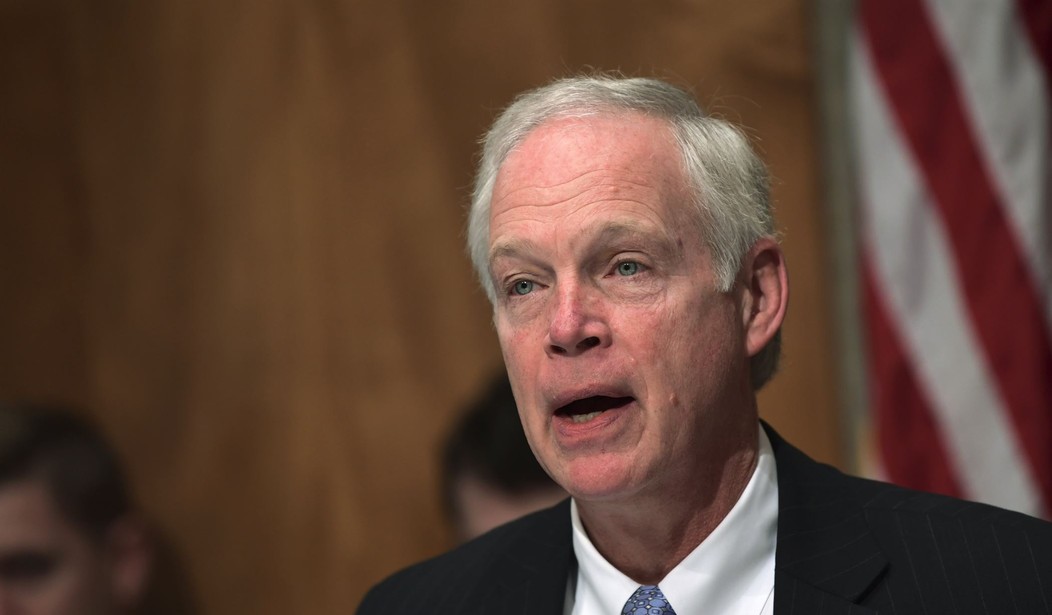

Well, the smooth road to tax reform just it a bump with Sen. Ron Johnson (R-WI) signaling that he will be a “no” vote on the legislation. The Wisconsin Republican is the first to definitively say he will be against the bill, as he feels it gives too much to corporations at the expense of other businesses. And he’s not the only one, according to The Wall Street Journal. Sen. Susan Collins (R-ME) is not a fan of the amendment to repeal Obamacare’s individual mandate. Sen. Jeff Flake (R-AZ) is worried the tax package adds too much to the deficit. The GOP needs every Republican to vote for this package. We’re back at it again with the vote count: they can only afford to lose two votes—and there are plenty of Republicans who can derail this whole legislative push (via WaPo):

Johnson said later in a statement that he could support a version of the bill if significant changes are made.

Separately, Sen. Susan Collins (R-Maine) said she had major concerns over Republicans changing their tax bill to include language repeal a major part of the Affordable Care Act, saying that was a “mistake.”

“This bill is a mixture of some very good provisions and some provisions I consider to be big mistakes,” Collins said.

The combined warnings from Johnson and Collins cast doubt over whether Republicans can find enough support to pass their bill.

[…]

There are a number of Senate Republicans who have not said how they will vote on the evolving bill. Sen. Bob Corker (R-Tenn.), for example, has said in the past he would not support a tax cut bill that included provisions that expired, as the new GOP bill is designed to do. Asked Wednesday, Corker said he was still reviewing the bill.

Another potential holdout, Sen. John McCain (R-Ariz.), repeatedly declined to say whether he’d vote for a tax bill that includes the proposed Republican change to the Affordable Care Act. McCain, who voted against a previous attempt to repeal the Affordable Care Act, said he wanted to review the tax bill as a whole.

Johnson’s complaint centers on how the Senate bill would tax on corporations versus other businesses.

The measure would permanently lower the corporate tax rate from 35 percent to 20 percent. But it would only temporarily create a new tax deduction for companies that pass through their income to shareholders through the individual income tax code, such as partnerships. Unless Congress acted later to extend those cuts, they would expire after 2025 and revert to the current tax system.

Recommended

Sens. Rand Paul (R-KY), Pat Toomey (R-PA), and Orrin Hatch (R-UT) could also cause heartburn for Mitch McConnell. Like with health care, this could be another bloody stumble as the 2018 election cycle is on the verge of kicking into gear.

Join the conversation as a VIP Member