Although some of the "fiscal cliff" taxes can be avoided through a deal made in Congress, new ObamaCare taxes are guaranteed to kick in on January 1, amounting to $268 billion tax hike. From Americans for Tax Reform:

The Obamacare Medical Device Tax – a $20 billion tax increase: Medical device manufacturers employ 409,000 people in 12,000 plants across the country. Obamacare imposes a new 2.3 percent excise tax on gross sales – even if the company does not earn a profit in a given year. In addition to killing small business jobs and impacting research and development budgets, this will increase the cost of your health care – making everything from pacemakers to prosthetics more expensive.

The Obamacare “Special Needs Kids Tax” – a $13 billion tax increase: The 30-35 million Americans who use a Flexible Spending Account (FSA) at work to pay for their family’s basic medical needs will face a new government cap of $2,500 (currently the accounts are unlimited under federal law, though employers are allowed to set a cap).

There is one group of FSA owners for whom this new cap will be particularly cruel and onerous: parents of special needs children. There are several million families with special needs children in the United States, and many of them use FSAs to pay for special needs education. Tuition rates at one leading school that teaches special needs children in Washington, D.C. (National Child Research Center) can easily exceed $14,000 per year. Under tax rules, FSA dollars can be used to pay for this type of special needs education. This Obamacare tax provision will limit the options available to these families.

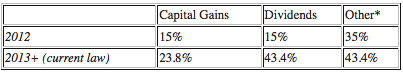

The Obamacare Surtax on Investment Income – a $123 billion tax increase: This is a new, 3.8 percentage point surtax on investment income earned in households making at least $250,000 ($200,000 single). This would result in the following top tax rates on investment income:The table above also incorporates the scheduled hike in the capital gains rate from 15 to 20 percent, and the scheduled hike in dividends rate from 15 to 39.6 percent.

The Obamacare “Haircut” for Medical Itemized Deductions – a $15.2 billion tax increase: Currently, those Americans facing high medical expenses are allowed a deduction to the extent that those expenses exceed 7.5 percent of adjusted gross income (AGI). This tax increase imposes a threshold of 10 percent of AGI. By limiting this deduction, Obamacare widens the net of taxable income for the sickest Americans. This tax provision will most harm near retirees and those with modest incomes but high medical bills.

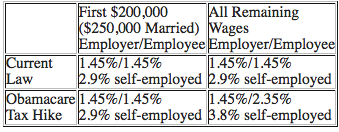

The Obamacare Medicare Payroll Tax Hike -- an $86.8 billion tax increase: The Medicare payroll tax is currently 2.9 percent on all wages and self-employment profits. Under this tax hike, wages and profits exceeding $200,000 ($250,000 in the case of married couples) will face a 3.8 percent rate instead. This is a direct marginal income tax hike on small business owners, who are liable for self-employment tax in most cases. The table below compares current law vs. the Obamacare Medicare Payroll Tax Hike:

Recommended

Not only will these taxes hit people in the wallet, but they will also have a negative long term effect on employment and the medical device industry.

Not only does this tax increase costs on companies, it also increases costs on hospitals, doctors and people in need of medical treatment that requires medical devices to be used. As a consequence of this, biomedical or medical device engineering firms are already laying off workers who develop crucial medical products due to the "unforeseen" costs, or in other words, the costs of ObamaCare. Not to mention, the more money these companies pay to the government, the less money they have to invest in research and development.

With this new medical device tax, students who pay large sums of money to get degrees in the field of biomedical engineering, just like doctors, will no longer see the benefits of going into the field and therefore, we will have a shortage of engineers developing new medical device technology. The medical device tax is a death sentence for American medical innovation.

This is only the beginning, the entire ObamaCare legislation kicks on by 2014 with many more tax hikes to come.

Join the conversation as a VIP Member