We've been talking about ObamaTax all year long, but here is a grim reality. ObamaCare is going to happen by law unless it is stopped and at this point, it doesn't look like that will happen. Americans for Tax Reform is giving us a look at the new ObamaCare tax form. On top of being long and complicated, the form requires individuals to submit personal health information to IRS agents.

When Obamacare’s individual mandate takes effect in 2014, all Americans who file income tax returns must complete an additional IRS tax form. The new form will require disclosure of a taxpayer’s personal identifying health information in order to determine compliance with the Affordable Care Act’s individual mandate.

So, how will this work?

Simply put, there is no way for the IRS to enforce Obamacare’s individual mandate without such an invasive reporting scheme. Every January, health insurance companies across America will send out tax documents to each insured individual. This tax document—a copy of which will be furnished to the IRS—must contain sufficient information for taxpayers to prove that they purchased qualifying health insurance under Obamacare.

This new tax information document must, at a minimum, contain: the name and health insurance identification number of the taxpayer; the name and tax identification number of the health insurance company; the number of months the taxpayer was covered by this insurance plan; and whether or not the plan was purchased in one of Obamacare’s “exchanges.”

This will involve millions of new tax documents landing in mailboxes across America every January, along with the usual raft of W-2s, 1099s, and 1098s. At tax time, the 140 million families who file a tax return will have to get acquainted with a brand new tax filing form. Six million of these families will end up paying Obamacare’s individual mandate non-compliance tax penalty.

Recommended

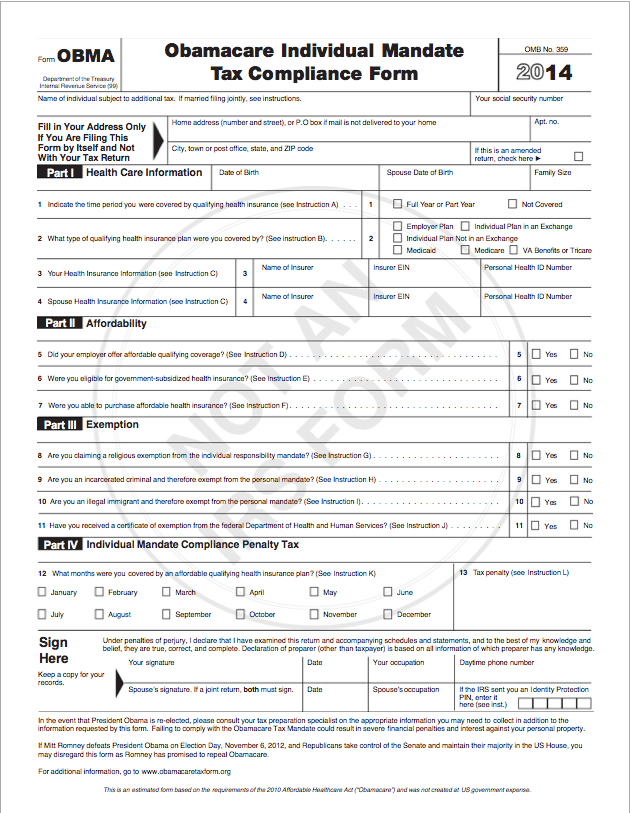

Formaphobic? This is what ATR predicts the form will look like:

Join the conversation as a VIP Member