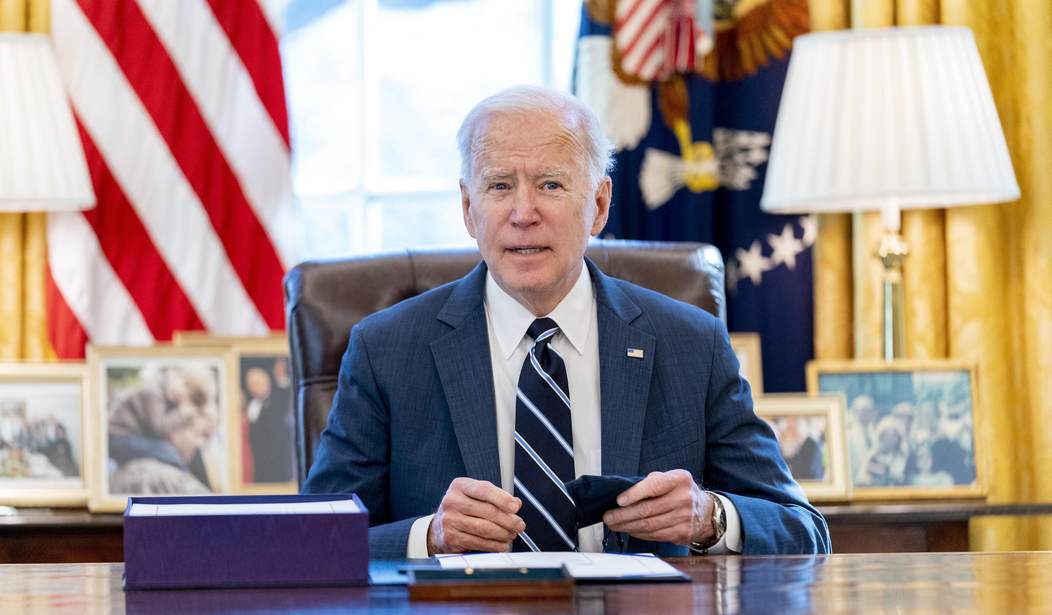

For the first time since 1993, the president of the United States may be enacting a major federal tax hike. The move by President Biden would come after his massive $1.9 trillion COVID "relief" deal, which Republicans termed a "progressive wish list."

According to Bloomberg, who first reported the news, Biden will announce his plans during his joint-session address to Congress, expected to take place this month. Sources tell the outlet that the president plans on raising the corporate tax rate from 21% to 28% and increasing taxes on individuals earning more than $400,000.

Four people familiar with the discussions told Bloomberg that the president’s proposal, while outright rejecting Sen. Elizabeth Warren’s wealth tax, would raise both the income tax rate for filers making more than $400,000 per year and the corporate gains tax for filers earning more than $1 million per year. Furthermore, Biden is expected to pursue a 7 percent increase in the corporate tax rate and limit ways for sole proprietorships and other “pass-through” businesses to avoid paying corporate taxes. (Daily Caller)

Conservatives criticized the report and made some dire predictions.

Living like Europeans while taxing only those who earn above $400k isn't sustainable. Everybody knows it. Which is why there will be bracket creep soon enough. https://t.co/UGRhwXmHgX

— Ben Shapiro (@benshapiro) March 15, 2021

"A government big enough to give you everything you want, is strong enough to take everything you have." https://t.co/AT2XZFm0AY

— Ken Blackwell (@kenblackwell) March 15, 2021

Recommended

How do Democrats plan to pay for their job-killing socialist agenda?

— NRCC (@NRCC) March 15, 2021

A $2 TRILLION tax hike.https://t.co/08LazgutjX

Wow what a great idea—let’s hike taxes while our American families are struggling to recover from a global pandemic, after eliminating near 50k energy related jobs overnight and while gas prices creep near $4/gallon. Brilliant. https://t.co/BC80RMQoV9

— C???????? O’N???? (@cathponeill) March 15, 2021

Rep. Kevin Brady (R-TX) similarly warned Biden that his tax hike would "further cripple a struggling economy" and that it would be "a terrible economic mistake." He worries that it will reverse the progress they had made with President Trump's tax cuts.

“And by that fair share, I mean there’s no reason why the top tax rate shouldn’t be 39.6 percent, which it was in the beginning of the Bush administration," Biden told The New York Times last year. "There’s no reason why 91 Fortune 500 companies should be paying zero in taxes.”

Join the conversation as a VIP Member