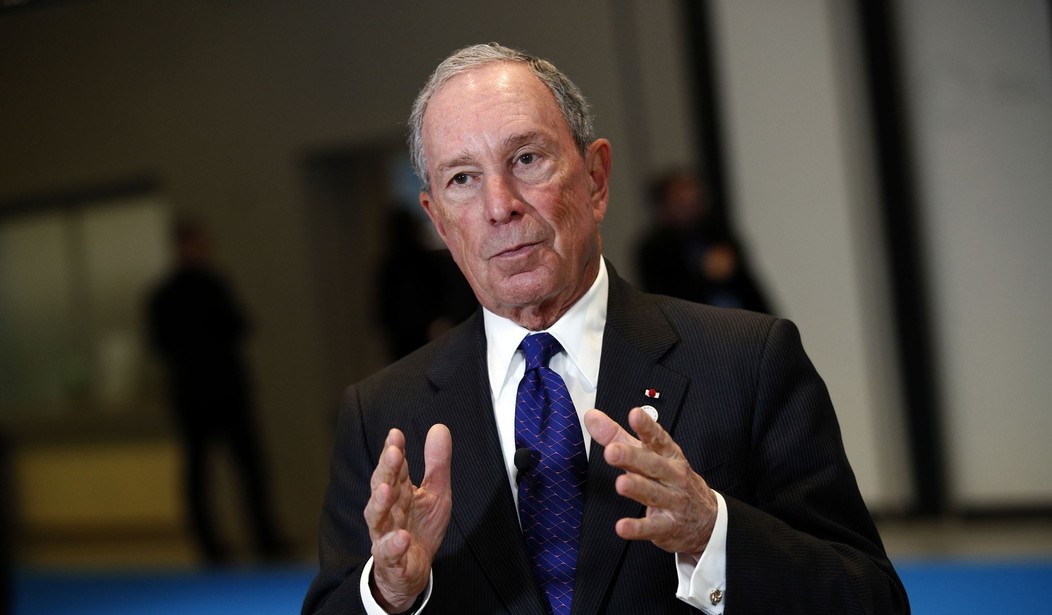

While erstwhile Republican mayor Mike Bloomberg's pledge to spend $80 million this year to elect Democrats has garnered headlines, another paternalistic effort of his is less noticed but likely more consequential. Fresh off an embarrassing defeat in Chicagoland, where Cook County repealed a Bloomberg-backed soda tax just weeks after it took effect, the former New York City mayor is going global with his push for regressive soda taxes, with a full-court press aimed at an upcoming September meeting of the United Nations General Assembly.

On June 1, the World Health Organization's High-Level Commission on Noncommunicable Diseases called for higher alcohol and tobacco taxes, but not soda taxes.

Bloomberg, who won't take "No Tax" for an answer, reacted by creating his own private panel led by former Obama economic adviser Larry Summers and stacked with politicians from around the world who have taxed or heavily regulated soda. Bloomberg's panel will issue its own report supporting soda taxes to compete with the official UN report when the General Assembly meets to discuss the issue in the fall.

Bloomberg recently made his case for steep, regressive soda taxes in an interview with IMF president Christine Lagarde at the IMF's spring meetings.

"Some people say, well, taxes are regressive," Bloomberg said. "Yes they are. That's the good thing about them because the problem is in people that don't have a lot of money. And so, higher taxes should have a bigger impact on their behavior."

"So it's regressive; it is good," Lagarde responded. "There are lots of tax experts in the room. And fiscal experts, and I'm very pleased that they hear you say that."

Bloomberg is so convinced that he knows what's best for middle and lower income people that he wants to put a painful, punitive tax on soda to, supposedly, save us from obesity. But the actual facts suggest soda is much less responsible for rising obesity than Nanny Mike thinks.

Calories in the average American diet from added sugars in soda are down 39 percent since 2000, and sales of non-diet soda are down 17 percent. Total soft drink calories shipped to schools dropped 90 percent from 2004 to 2010.But obesity rates continued to rise.

On a longer timescale, the USDA found that as the average American increased calorie consumption from 2,024 in 1970 to 2,481 in 2010, 88 percent of the increase came from fat and starch while increased sugar consumption - from all sources - accounted for just 40 calories.

And of course, even though Bloomberg rationalizes that he is taxing the little people for their own good, the economic consequences are no less painful.The tax hits those who can least afford it the hardest, cripples neighborhood stores, and might actually push people to less healthy choices - in Philadelphia, the soda tax made soda more expensive than beer.

Moreover, while the pitch to the public is that soda taxes are a public health measure, the pitch to politicians is something else entirely - that this is a new, attractive source of revenue for government spending.

In fact, one taxpayer-funded study by Harvard and Tufts professors advocating soda taxes noted "tax advocates must take care to match their message with the process... when the process is a ballot issue, success is more likely with a health framing than a budget framing... The politics changes with a city council vote, where more revenue to spend is highly attractive."

Taxes are always about the money.

Self-styled public health advocates could do a lot more good investing in educating parents, promoting healthier lifestyles, and managing portion sizes than telling people they are incapable of making their own decisions and will be forced to stop drinking soda through steep, regressive taxes. Even if Bloomberg succeeds in getting the United Nations to endorse his soda taxes, that won't make them any less economically and politically poisonous.

Join the conversation as a VIP Member