I’d say it’s official; President Obama’s Watergate has arrived. And the witty question originally formed for Nixon’s big scandal can now be re-applied to President Plausible Deniability, “What did he not know and when did he not know it?” While I do think that IRS-Gate spells the end of this President’s ability to effectively advance the liberal agenda, I do not see an impeachment on the horizon; at least not for Barack Obama – but perhaps for the Sixteenth Amendment.

The recent parade of citizen witnesses to congressional hearings has laid bare the raw suffering that inevitably comes from tolerating the existence of a despotic government agency. To gain an appreciation for the IRS scandal, one need only hear the eight minute statement from citizen Becky Gerritson before the House Ways and Means Committee. Gerritson’s elocution should be required viewing for every citizen and immigrant over the age of 16, perhaps set to an inspirational John Williams soundtrack. Juxtaposed to Ms. Gerritson are the strained testimonies from IRS employees where I keep expecting to hear that fast paced Benny Hill music welling up in the background.

The righteous momentum against IRS arrogance creates an opportunity for righting a 100–year-old wrong. This past February 3rd marked exactly one century since the Sixteenth Amendment to the U.S. Constitution was ratified, giving Congress the “power to lay and collect taxes on incomes.” This disastrous decision ultimately reversed the positions of servant and master between America’s citizens and their federal government.

The accounting nightmare created by today’s 50,000 pages of tax law and regulations has produced a natural hostility between citizens and government, acted out on annual and quarterly cycles. Misinterpretations and non-compliance result in fines, property seizure, and criminal prosecution. The enforcement power given to the agency strikes fear in taxpayers, businesses, charities, and churches, and the temptation has proven to be too much. Politicians and bureaucrats have leveraged this position to influence desired behaviors.

Recommended

The institutional corruption of government cruelty toward political advantage has placed Washington, DC on a crash course with Mount Rushmore. But while Democrats and Republicans fight over the control stick, National Review correspondent Kevin Williamson has been unbuckling his seatbelt and strapping on a wingsuit. Williamson’s new book arrives with the most appealing (albeit lengthy) title of any political commentary that I have ever seen: “The End Is Near and It's Going to Be Awesome: How Going Broke Will Leave America Richer, Happier, and More Secure.”

Williamson is right, of course, that the current arrangement is completely unsustainable. And rather than scream all the way into the mountainside, I agree with Williamson that we should prepare to step in with solutions that reflect the Founding Fathers’ pre-Sixteenth-Amendment wisdom. And in an attempt to out-play us, watch for liberals to begin supporting a flat tax solution.

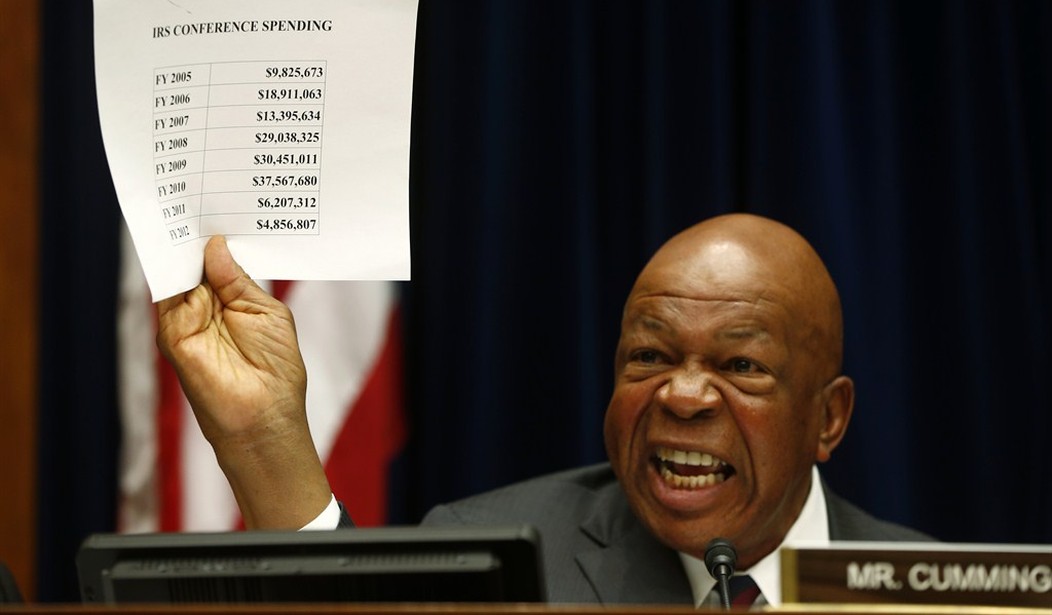

The IRS is appropriately being criticized by both major parties. Releasing the Commissioner into an early retirement does not equal the crime. A systemic change must come to the collection of taxes for the federal government. But the Democrats will soon realize that too much of a change will ruin their ability to control the masses on an individual basis. And by modifying the current complexity to a flat tax, Democrats would trade short term manipulations for maintaining their long term position of control over the individual.

A flat tax would merely simplify the fiasco. It would not resolve anything. Taxing income is the problem. Republicans should move to repeal the Sixteenth Amendment to the United States Constitution.

There are two worthy alternatives on the table right now; the Liberty Amendment and the Fair Tax. In 1998 Congressman Ron Paul (R-TX) first introduced the Liberty Amendment, a straightforward proposal that repeals the ability to tax income and restricts the federal government to programs specifically enumerated in the Constitution. In 1999 Congressman John Linder (R-GA) first introduced legislation known as the Fair Tax Act. The Fair Tax has received more congressional member support than both the Liberty Amendment and flat tax schemes.

The Liberty Amendment does not attempt to provide solutions to the lost revenues for the federal government. For me, the wisdom in this approach is a forced reduction in the size of the federal government along with re-thinking revenue sources.

The Fair Tax begins with a national sales tax as a replacement for income tax. The IRS is eliminated and the economy would receive a certain boost. It also attempts to replace welfare, unemployment, and other government social involvements with a unified monthly cash payment to every legal resident. The idea here is to collect enough sales tax to fund the government and to send a minimal subsistence payment to everyone, no matter how rich or poor they happen to be.

Ron Paul said of the Fair Tax, “We don’t need to replace the income tax at all. I see a consumption tax as being a little better than the personal income tax, and I would vote for the Fair Tax if it came up in the House of Representatives, but it is not my goal. We can do better.” There is a lot to like about the Fair Tax and a lot to be concerned about, especially the opportunity for liberal mischief in developing dependencies with the cash payments.

But regardless of the final revenue solution, we need to head Rahm Emanuel’s advice that, “You never want a serious crisis to go to waste.” It has now been proven beyond any reasonable doubt that the existence of an agency such as the IRS is too great of a temptation for ambitious politicians. The Sixteenth Amendment must be repealed. Further, the very purpose of taxation should be refined to funding government operations. It should never be allowed for social engineering, redistributions, punishment, or spying.

Or as Becky Gerritson bravely told the government in person, “It’s not your right to assert an agenda.”

Join the conversation as a VIP Member