The Facebook IPO has brought valuations of start ups front and center. Angel investors and VC’s think about valuation constantly. Rarely is there a magic black box algorithm that you can run numbers through and pop out with a number that is exact. Valuation of companies is still an art form.

Facebook’s IPO stumbled for a variety of reasons. Not to go too deeply in it, but all three parties to executing the IPO fumbled. Facebook($FB), Morgan Stanley($MS) and NASDAQ ($NDAQ). They also went public in a bear market, so the company got no market mojo to lift their shares. Facebook is still a great company.

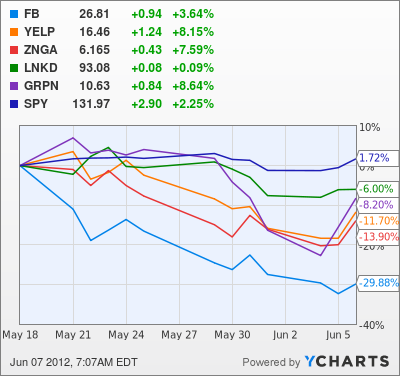

Interestingly, the rest of the social media space fared poorly as well. Zynga($ZNGA), LinkedIN($LNKD), Yelp($YELP), and Groupon($GRPN) all lost ground. Does this mean they were over valued?

I don’t think so. I believe the market is smarter than any one person, any one analyst. All public information is priced into the shares of public companies. The market is rational on a macro level. On a micro level, there are brief snippets of time where public information isn’t reflected in the price. That’s where arbitrage opportunities are available to anyone quick enough to seize them. Believe me, it’s not the average investor. Computers sop up those nickels really quickly.

But what about companies that aren’t public? Start ups. Paul Graham runs Y Combinator, a successful incubator in California. His basic points were these:

1. If you haven’t raised money, lower your expectations for fundraising

2. If you have raised money on a convertible note with a high cap, you will get a lesson in actual valuation.

3. If you raised money in an equity round at a high valuation, be prepared for a down round.

Graham offers good advice. One thing good mentors always tell entrepreneurs is to listen to the market. If the market consistently tells you one thing that goes against what you believe, then you are wrong. The market is rarely if ever wrong.

Recommended

The pricing of the start up market is no different than any other market. There is a set of intersecting supply and demand curves. The value of the company is just the price.

But I think that the fault of high valuations doesn’t lie with the start ups. It lies with the investors, because we set the price for the market. If we weren’t buying at the higher prices, no trades would be made, supply and demand curves would shift and price would fall. Because of the success of several start ups recently, demand curves of investors shifted causing prices to rise. Graham predicts that they will shift back and prices will fall. Maybe he is right.

Why are investors putting money into companies with uncapped convertible notes? It makes zero sense to me and I would never invest in an uncapped round. It changes the risk profile of the deal. Instead of the founder taking risk, the investor assumes the lion’s share of risk and if the company fails gets it all. If the company is a success, the next round of investors get the benefit because the initial investors are left naked on the price they are buying at. Investing in uncapped convertible notes is sort of like giving your stock broker a big “buy at the market” order in a bull market. When the market turns around, you won’t be happy.

Investors are afraid to have the very difficult conversation with founders about company value. Uncapped notes avoid it. If I were an entrepreneur, I’d go for an uncapped note too-and then get everyone to invest a lot of money as if it was a priced round. There is more value for me. Investors need to engage in that conversation because not only do you protect your risk, but you learn a lot about the entrepreneur.

They say you can learn a lot about a person when you play golf with them. A discussion with an entrepreneur about enterprise value is like playing 18 holes. Discussions on valuation will let you know how the entrepreneur really thinks about their business. You will find out things personally about them. Are they coachable? Do they handle controversy and stress well?

Raising the right amount of money brings discipline to the start up. Having a valuation discussion before the investment is made brings discipline to investors. In recent years, they lost their discipline. Hopefully the Facebook IPO will be a splash of cold water on their faces, and they will get it back. The investors that don’t have discipline will lose money. Then they will be out of the game, unless they find a way to get a government bail out.

Join the conversation as a VIP Member