The following is an excerpt from “Secrets of the Trading Pros: Techniques & Tips that Pros Use to Beat the Markets” by Jack Bouroudjian.

The events of September 11, 2001, will be written about for years to come. But rather than spend time writing about the causes behind the event, I will tell you what happened in my world during those difficult days. Many things happened behind the scenes at the CME, and much of what was done, directly or indirectly, affected the entire market and the psychology that pervades it. I think of the event itself as the Kennedy assassination of our time. Everyone remembers exactly where they were that morning.

If any single event let the entire world know that the days of bull market innocence had come to an end, September 11 and its aftermath were it. In fact, the event constitutes a perfect case study of the changing of the collective psychology of the marketplace in a single day. No other news event caused more market disruption and confusion than that. Understanding the emotional impact of the event is important for anyone trading the markets today because much of the psychology that surrounds today’s trading was caused by 9/11!

For me, September 11 started like any other day with an early trip to the CME floor to do CNBC and Bloomberg TV before heading back to the Commerz offices. I was scheduled for a 9am TV appearance to talk about the economic releases coming out that morning.

As I watched CNBC, I heard Mark Haines say something about a plane hitting the World Trade Center. My first reaction was to call Vinny McLaughlin and Denny DeCore, who were at the Nomura offices across the street from the WTC, at the world Financial Center. I asked them if they could see what was happening and if they were safe. They told me they were fine but it looked as if a traffic copter or something small had hit the tower. From their angle it was difficult to see the extent of the damage caused by the first plane.

Walking on to the upper trading floor at the Merc, I saw my old friend Peter Yastrow, who had taken a position with Cantor Fitzgerald covering their proprietary traders and brokers. Cantor’s New York offices were on a high floor in the tower that had been hit, and Peter and his colleagues at the desk looked concerned.

Recommended

Something was wrong—clerks were wiping away tears as they left the floor. When I asked what was happening, I was told that the traders and brokers on the other end of the phone in New York had realized they were not going to make it and had asked the clerks in Chicago to say goodbye to their families for them. Imagine being on the phone with people who know they’re going to die, and there is nothing you can do!

Although the stock market had not yet opened, the electronic futures market began to break hard. As we watched the TV for details about the first tower, we all looked on in horror as the second plane hit the other tower. It was at this point that the event became world changing. People sensed the panic. Brokers began yelling that there were other planes in the air not accounted for and that the CME could be a possible target. I urged everyone to calm down, and allowed anyone to leave if they wanted to. I sent my whole crew home and told everyone associated with my operation that I would call them with more information as it became available.

I was called to the control center adjacent to the S&P pit to confer with the New York markets on whether they would open. During the course of the teleconference, we all turned to the TV as Mark Haines announced that the first tower had collapsed.

With that, it was decided that the stock market in New York City would not open and that the CME would close its futures market. I immediately called Vinny and Denny in New York. They had fortunately left the building after the second plane had hit. Later they would tell me that they could see the second plane as it sped along the river before hitting the second tower. At that point they evacuated the World Financial Center and the island of Manhattan.

Everyone else was vacating the CME floor, but I felt that I should stay to help with any disaster recovery that might be necessary. Aside from being on the CME board of directors, my responsibilities also included a seat on the Commerzbank Futures board.

The U.S. headquarters for the bank was located in the World Financial Center, a few floors above Vinny and Denny. By the time I called, the entire banking division was out of the building and setting up shop in a warehouse some 25 miles away in New Jersey. I knew that Frankfort would ask about the situation and how the exchange was dealing with the catastrophe.

continued tomorrow...

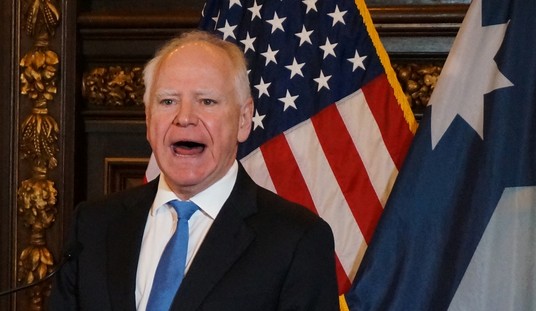

John Ransom | Create Your Badge

See more top stories from Townhall Finance. New Homepage, more content. Be the best informed fiscal conservative:

| John Ransom | Obama's Solyndra Loans "Number One Priority" for House Investigating Committee Since Feb. |

| Political Calculations | Projection: Hard Landing for Obama Next Fall |

| Mike Shedlock | Taxing the Dead |

| Bill Tatro | A Flat Business Tax |

| Bob Goldman | Happiness Is Now a Requirement at Work |

| Jeff Carter | Groupon, Zynga and Krugman's Frothy Valuations |

| Jack Bouroudjian | 9/11 Hit Financial Markets Hard, Personally |

| Email Ransom | thfinance@mail.com |

| http://twitter.com/#!/bamransom |

Join the conversation as a VIP Member