People sometimes think I’m strange for being so focused on the economic harm that results from third-party payer. But bear with me and we’ll see why it’s a very important issue.

If you’re not already familiar with the term, third-party payer exists when someone other than the consumer is paying for something. And it’s a problem because people aren’t careful shoppers when they have (proverbially) someone else’s credit card.

Moreover, sellers have ample incentive to jack up prices, waste resources on featherbedding, and engage in inefficient practices when they know consumers are insensitive to price.

I’ve specifically addressed the problem of third-party payer in both the health-care sector and the higher education market.

But I’ve wondered whether my analysis was compelling. Is the damage of third-party payer sufficiently obvious when you see a chart showing that prices for cosmetic surgery, which generally is paid for directly by consumers, rise slower than the CPI, while other health care expenses, which generally are financed by government or insurance companies, rise faster than inflation?

Or is it clear that third-party payer leads to bad results when you watch a videoexposing how subsidies for higher education simply make it possible for colleges and universities to increase tuition and fees at a very rapid clip?

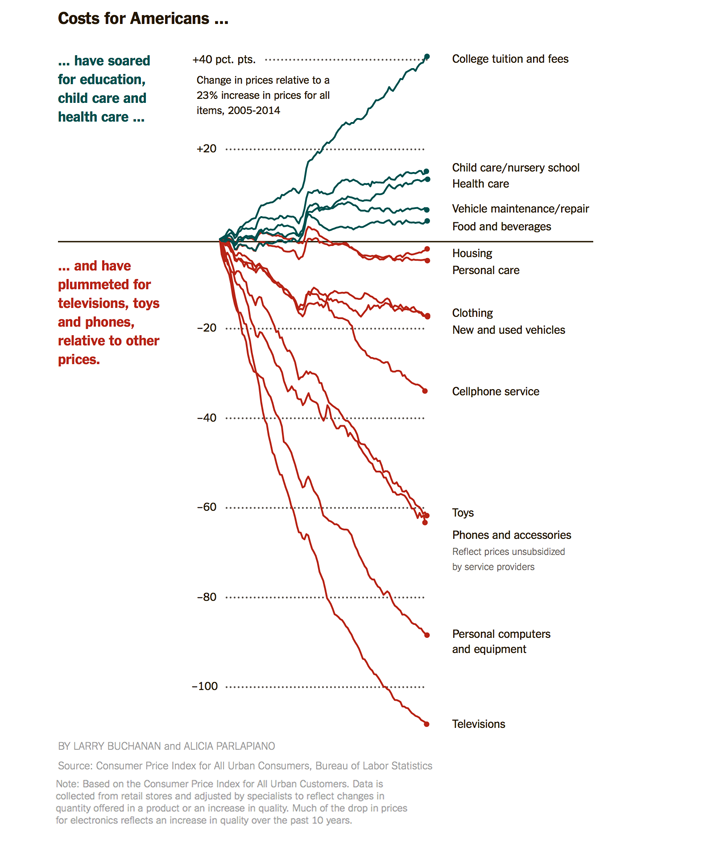

That should be plenty of evidence, but I ran across a chart that may be even more convincing. It shows how prices have increased in various sectors over the past decade.

So what make this chart compelling and important?

Recommended

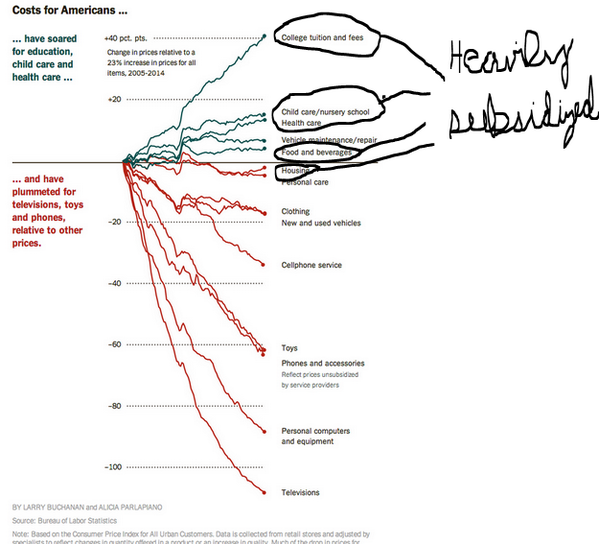

Time for some background. The reason I saw the chart is because David Freddoso of the Washington Examiner shared it on his Twitter feed.

I don’t know if he added the commentary below, or simply passed it along, but I’m very grateful because it’s an excellent opportunity to show that sectors of our economy that are subsidized (mostly by third-party payer) are the ones plagued by rising prices.

It’s amazing to see that TVs, phones, and PCs have dropped dramatically in price at the same time that they’ve become far more advanced.

Yet higher education and health care, both of which are plagued by third-party payer, have become more expensive.

So think about your family budget and think about the quality of PCs, TVs, and phones you had 10 years ago, and the prices you paid, compared with today. You presumably are happy with the results.

Now think about what you’re getting from health care and higher education, particularly compared to the costs.

That’s the high price of third-party payer.

P.S. This video from Reason TV is a great illustration of how market-based prices make the health care sector far more rational.

Join the conversation as a VIP Member