One of the challenges of good entitlement reform (or even bad entitlement reform) is that recipients think they’ve “earned” benefits.

If you tell them that programs such as Medicare are unsustainable and need to be changed, some of them suspect you’re trying to somehow cheat them. After all, they were forced to cough up payroll taxes during their working year.

That’s true, but the real issue is how much did they pay in tax and how much are they getting back.

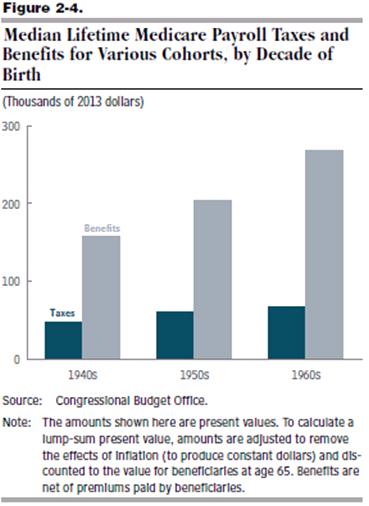

Here’s a very sobering chart from the recently released Long-Term Fiscal Outlook from the Congressional Budget Office.

It shows that people in their 50s, 60s, and 70s paid, on average, between $45,000-$65,000 of taxes into Medicare. That’s a big chunk of money, but it’s far less than the $160,000-$270,000 that Medicare will spend on them.

I’m tempted to say that current retirees and older workers are being charged for a hamburger but they’re getting a steak.

But that’s not accurate. As most recipients will tell you, Medicare leaves a lot to be desired, which is what you might expect with a government-run system.

So the right way to look at the program is that recipients are being charged for a hamburger, they’re getting a hamburger, but taxpayers (the ones who make up the funding gap) are being charged for a steak.

Which is why structural reform is the only good way of dealing with the program’s giant unfunded liability. As explained in this video from the Center for Freedom and Prosperity.

Recommended

As discussed in the video, the reform (which has been part of the Ryan budget that’s been approved by the House) basically leaves the program as is for current retirees and older workers, but younger workers are allowed to move to a new system that gives them – upon retirement – the ability to choose their preferred health policy.

P.S. Don’t forget that we also need to reform Medicaid and Social Security, the other two big entitlement programs.

Join the conversation as a VIP Member