I generally believe that social conservatives and libertarians are natural allies. As I wrote last year, this is “because there is wide and deep agreement on the principle of individual responsibility. They may focus on different ill effects, but both camps understand that big government is a threat to a virtuous and productive citizenry.”

I even promoted a “Fusionist” principle based on a very good column by Tim Carney, and I suspect a large majority of libertarians and social conservatives would agree with the statement.

But that doesn’t mean social conservatives and libertarians are the same. There’s some fascinating research on the underlying differences between people of different ideologies, and I suspect the following story might be an example of where the two camps might diverge.

But notice I wrote “might” rather than “will.” I’ll be very curious to see how various readers react to this story about a gay couple that is taking an unusual step to minimize an unfair and punitive tax imposed by the government of Pennsylvania.

John met Gregory at a gay bar in Pittsburgh nearly 45 years ago and immediately fell in love. …Now, as lifelong partners facing the financial and emotional insecurities of old age, they have legally changed their relationship and are father and son — John, 65, has adopted Gregory, 73. The couple was worried about Pennsylvania’s inheritance tax. “If we just live together and Gregory willed me his assets and property and anything else, I would be liable for a 15 percent tax on the value of the estate,” said John. “By adoption, that decreases to 4 percent. It’s a huge difference.” …the couple had considered marrying in another state, but because their primary residence was in Pennsylvania, which does not recognize same-sex marriage, they would still be subjected to the inheritance law.

Recommended

The Judge who approved the adoption obviously wasn’t too troubled by this unusual method of tax avoidance.

The judge did turn to John and said, “I am really curious, why are you adopting [Gregory]?” “I said, ‘Because it’s our only legal option to protect ourselves from Pennsylvania’s inheritance taxes,’” said John. “He got it immediately.” The judge agreed to sign the adoption papers on the spot and handed it to the clerk. Then he turned and looked at John, “Congratulations, it’s a boy.”

So what’s your take on this issue? For some groups, it’s easy to predict how they’ll react to this story.

1. If you have the statist mindset of England’s political elite or if you work at a bureaucracy such as the OECD, you’ll think this is morally wrong. Not because you object to homosexuality, but because you think tax avoidance is very bad and you believe the state should have more money.

2. If you’re a libertarian, you’re cheering for John and Gregory. Even if you don’t personally approve of homosexuality, you don’t think the state should interfere with the private actions of consenting adults and you like the idea of people keeping more of the money they earn.

3. If you’re a public finance economist, you think any form of death tax is a very perverse form of double taxation and you like just about anything that reduces this onerous penalty on saving and investment.

But there are some groups that will be conflicted.

1. Social conservatives don’t like big government and bad tax policy, but they also don’t approve of homosexuality. And, in this case, it’s now technically incestuous homosexuality! If I had to guess, most social conservatives will argue that the court should not have granted the adoption. We’ll see if there are some good comments on this post.

2. Leftists also will be conflicted. They like the death tax and they want the government to have more money, but they also believe in identity politics and wouldn’t want to offend one of their constituent groups. I’m guessing identity politics would trump greed, but I suspect their ideal approach would be to tax all inheritances at 15 percent.

In my fantasy world, needless to say, there’s no death tax and the entire issue disappears.

Tax Havens Are Good for High-Tax Nations

Regular readers know that one of my main goals is to preserve and promote tax competition as a means of restraining the greed of the political class. Heck, I almost wound up in a Mexican jail because of my work defending low-tax jurisdictions.

As you can imagine, it’s difficult to persuade politicians. After all, why would they support policies such as fiscal sovereignty and financial privacy that hinder their ability to extract more revenue?

So I try to educate them about the link between taxes and growth in hopes that they will understand that a vibrant economy also means a large tax base.

And I specifically tell them that so-called tax havens play a very valuable role since they are an alternative source of investment capital for nations that have undermined domestic investment with bad tax policy.

And I also explain to them that low-tax jurisdictions give companies some much-needed flexibility to maintain operations in an otherwise hostile fiscal environment. Let’s look at that specific issue by reviewing some of the findings from a study by two Canadian economists about tax havens and business activity.

In the introduction to their study, they describe the general concern (among politicians) that competition between governments will lead to lower tax rates.

Increased mobility of goods and services is apt to give rise to an erosion of corporate tax bases in high-tax industrialized countries, a decline in tax revenues and a rise in competition among governments. Countries seeking to attract and retain mobile investment and the associated tax revenues may be induced to reduce tax rates below the levels that would obtain in the absence of mobility. In the view of some commentators, indeed, increased mobility can lead to a “race to the bottom” driving business tax rates to minimal levels, due to the fiscal externalities that mobility creates.

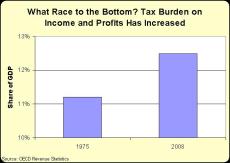

It certainly is true that tax competition has pressured politicians to lower tax rates, and the academic research shows that this is a good thing, notwithstanding complaints by leftists economists such as Jeffrey Sachs.

What folks on the left don’t understand is that there is a big difference between tax rates and tax revenue. Thanks in large part to Laffer-Curve effects, the big decline in tax rates in the past three decades has not led to a decline in tax revenues.

Indeed, taxes on income and profit, measured as a share of GDP, have increased as tax rates have declined.

But I’m getting distracted. The purpose of this post is to analyze the findings of the two Canadian economists.

Here are their major conclusions, which show that tax havens actually help high-tax nations by allowing companies to engage in “real economic activities” in spite of punitive tax policies.

Financial mobility is manifested in the decisions of multinational enterprises to separate research and development and capital financing activities from production and sales of outputs, and so to engage in “tax planning” to realize income from intellectual property and from capital in jurisdictions different from those where real economic activities are located. …While tax planning may reduce revenues of high-tax jurisdictions, therefore, it may have offsetting effects on real investment that are attractive to governments. In principle, then, the presence of international tax planning opportunities may allow countries to maintain or even increase high business tax rates, while preventing an outflow of foreign direct investment. …the investment-enhancing effects of international tax planning can dominate the revenue-erosion effects. The implications of this view are strong: an increase in international tax avoidance can lead to…an increase in the welfare of citizens of high-tax countries. …consistent with our model, governments may be reluctant to close such “loopholes,” because of fears of losses in multinational employment and, in particular, expatriations of ownership and headquarters operations to low-tax countries. …revenue losses due to tax planning are irrelevant, and what matters is the effect of tax planning on the level of multinational investment in high-tax countries and its deadweight costs for the economy, if any.

In other words, tax havens make it possible for companies to indirectly reduce their overall tax burden, thus making it economically feasible to continue operating – and retaining jobs – in nations with bad tax policy.

Other economists have reached similar conclusions. At about the 7:20 mark of this video, I cite research by Mihir Desai, Fritz Foley, and James Hines that also found that tax havens facilitate greater economic activity in high-tax nations.

P.S. I’ve done lots of debates about tax havens (on American TV, British TV, and French TV) and those of you attending FreedomFest can see me cross rhetorical swords in a debate with James Henry of the Tax Justice Network. As you can see from the agenda, I’ll also be moderating a panel on tax reform and introducing Charles Murray’s talk on how to limit the state.

P.S.S. There’s something about tax havens that causes statists to become even more irrational than they usually are. Some of them actually advocate military action against these peaceful jurisdictions! I’m wondering if this is their way of compensating for the guilt that they feel since many well-known leftists invest their money in these low-tax jurisdictions.

Join the conversation as a VIP Member