Stocks in the News is produced by Ransom Notes Radio and Goodfellow, LLC. Crista Huff manages Goodfellow LLC, a website that recommends outperforming stocks using fundamental and technical analysis.

Stock number one is:

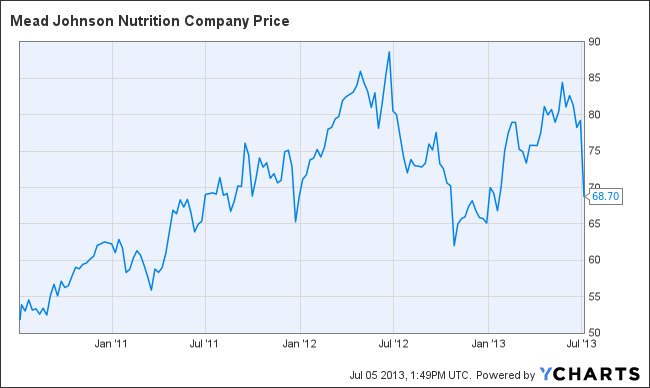

Mead Johnson Nutrition Company, (SYMBOL: MJN) and the headline says:

Heightened Risks Following Competitive Price Cuts – Morgan Stanley

After a July 1 accusation of alleged baby formula price-fixing in China, several large foreign manufacturers cut retail prices this week, forcing Mead Johnson Nutrition to follow suit with its Enfamil product, or lose market share. The tactic seems to be a government ploy designed to support domestic manufacturers, bringing risk to near-term earnings and medium-term pricing power at Mead Johnson.

The pricing change will knock earnings growth down about 5% in 2013 & ’14, giving the company about a one percent earnings growth scenario this year.

The stock fell to support around $68 and will likely be stuck in this two-year trading range for quite a while longer.

Our Ransom Note trendline says: STAY ON THE SIDELINES.

Stock number two is:

Hewlett-Packard Co., (SYMBOL: HPQ) and the headline says:

HP retains Navy contract in $3.5 billion award -- Newsday

Hewlett-Packard Co. won a $3.5 billion contract to continue running the U.S. Navy’s communications network for the next five years. Revenue from the project will fall 37% from the previous contract due to competition, smaller project size, and federal budget cuts.

Earnings are projected to fall 12% this year, followed by two no-growth years. The PE is 7.1 and the dividend yield is 2.3%.

Recommended

We think the worst is over for HP stock, and we’re changing our recommendation from sell to hold. Expect the stock to trade between $23 and $30 for a while.

Our Ransom Note trendline says: HOLD HEWLETT-PACKARD.

Stock number three is:

Novartis AG, (SYMBOL: NVS) and the headline says:

An Opportune Time for An Investor Bear Hug – Citi Research

After recent management changes at multinational healthcare company Novartis, Citi Research expects the company to shore up investor confidence by resuming a $10 billion buyback plan and/or announcing a strategic review to maximize value in its Consumer division. The stock price also suffers from a heavily undervalued late-stage pharmaceutical pipeline.

Earnings are projected to fall 3% this year, then rise 6 and 10 percent the next two years. The dividend yield is 2.23%.

The stock broke out of a long-term trading range in January, rose 20%, then had a big pullback. Expect Novartis to trade between $70 and $75 for a while now.

Our Ransom Note trendline says: HOLD NOVARTIS

Join the conversation as a VIP Member