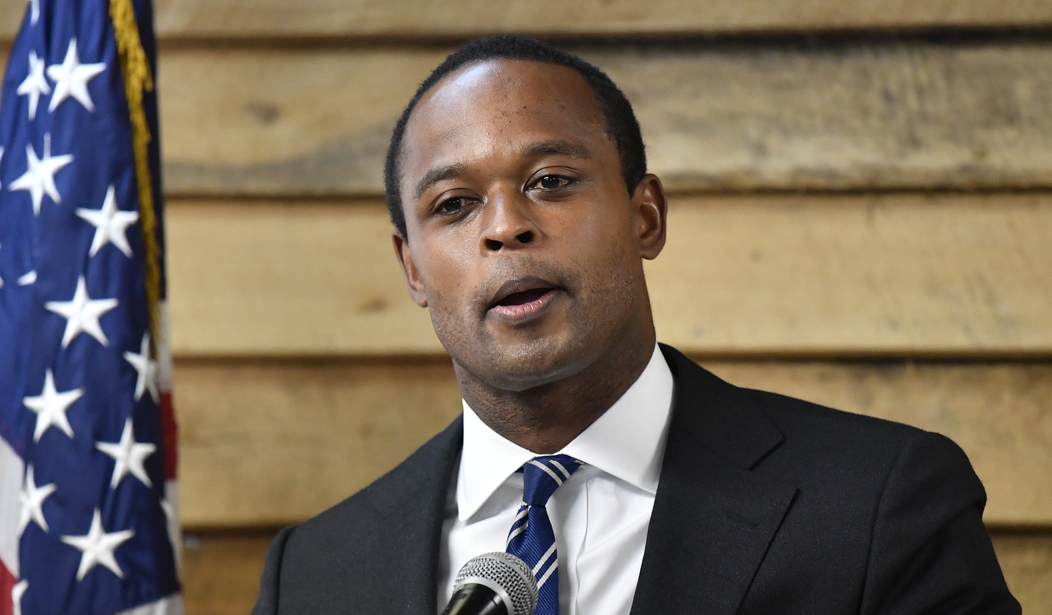

While the World Economic Forum was hosting its “Annual Meeting” in Davos, Switzerland and pushing for the worldwide implementation of environmental, social, and governance (ESG) investing metrics, Kentucky Attorney General Daniel Cameron issued a scathing letter against ESG investing, declaring that it does not comport with Kentucky law.

According to the letter, “There is an increasing trend among some investment management firms to use money in public and state employee pension plans—that is, other people’s money—to push their own political agendas and force social change.”

By this, Cameron is referring to the fact that giant financial firms such as BlackRock, which have substantial holdings in public pension plans, have begun to push ESG investing in order to further their political aims instead of maximizing investment returns.

As Cameron describes the problem, “‘Stakeholder capitalism’ and ‘environmental, social, and governance’ investment practices, which introduce mixed motivations to investment decisions, are inconsistent with Kentucky law governing fiduciary duties owed by investment management firms to Kentucky’s public pension plans.”

In the blink of an eye, ESG investing has become all the rage among big banks and globalist organizations. Simply put, Wall Street and other large financial institutions are on-board with ESG because it vastly increases their power by allowing them to determine who and what companies will have access to capital based solely upon their adherence to entirely subjective ESG scores.

Recommended

What’s more, because ESG metrics are subjective in nature, and subject to change at a moment’s notice, it allows big banks and the like to nudge society in any direction our “betters” choose at a given point in time.

Right now, ESG scores heavily favor companies on the “right side” of the climate change debate. They also currently reward companies that toe the “Diversity, Equity, and Inclusion” line. But, these metrics are not set in stone by any means, and can be manipulated to accomplish any pie-in-the-sky cause in the not so distant future.

As the Kentucky attorney general makes clear, it is one thing for Wall Street to funnel its own funds into these ESG investment vehicles. After all, Wall Street and big financiers retain carte blanche when it comes to how they invest their own money. However, it is an entirely different conversation when these mega-banks peddle the public’s money into their pet projects.

Per Cameron’s letter, “One investment management firm, at one time directing roughly $1.5 billion on behalf of the Kentucky Public Pension Authority, 15 has made a ‘firmwide commitment to integrate ESG information into [its] investment processes’ to affect ‘all of [its] investment divisions and investments teams.’ 16 Other investment management firms that direct billions of dollars in Kentucky pension fund investments have publicly made similar commitments to ESG investment practices.”

But, does this type of investing with public funds violate Kentucky law? According to Cameron, the answer is a resounding yes.

“State and federal law have long recognized fiduciary duties for those who manage other people’s money,” Cameron writes. Moreover, “While asset owners may pursue a social purpose or ‘sacrifice some performance on their investments to achieve an ESG goal,’ 25 investment managers entrusted to make financial investments for Kentucky’s public pension systems must be single-minded in their motivation and actions and their decisions must be ‘[s]olely in the interest of the members and beneficiaries [and for] the exclusive purpose of providing benefits to members and beneficiaries.’”

In other words, according to Kentucky law, when it comes to investing state public pension plan funds, old-fashioned fiduciary duty trumps ESG investing’s subjective criteria.

Further, as Cameron makes abundantly clear, it is illegal to pursue ESG investing over maximizing potential investment returns for state and public pension plan accounts. “In sum, politics has no place in Kentucky’s public pensions. Therefore, it is the opinion of this Office that ‘stakeholder capitalism’ and ‘environmental, social, and governance’ investment practices that introduce mixed motivations to investment decisions are inconsistent with Kentucky law governing fiduciary duties owed by investment management firms to Kentucky’s public pension plans,” the letter states.

ESG investing may well make Wall Streeters and globalists more powerful and wealthy than they ever could have imagined. On the other hand, it could also trigger a grassroots tidal wave of opposition to the crass cronyism on display. It is too early to tell which direction ESG investing will take, but the fact that states such as Kentucky are pushing back is a very good sign for those who favor free-market capitalism, also known as shareholder capitalism, over the newfangled nonsense that has come to be known as “stakeholder capitalism” and ESG investing.

Chris Talgo (ctalgo@heartland.org) is senior editor at The Heartland Institute.

Join the conversation as a VIP Member