After meandering most of the session on Thursday, the market finally attracted buyers. All the major indices finished higher, and market breadth was solidly bullish. During the session, however, something interesting happened.

The hottest stocks fell back, as the struggling stocks came on like gangbusters.

Market Breadth | NYSE | NASDAQ |

Advancing | 2,113 | 2,192 |

Declining | 938 | 1,295 |

52 Week High | 49 | 72 |

52 Week Low | 26 | 40 |

Up Volume | 3.23B | 2.22B |

Down Volume | 801.24M | 1.04B |

Positioning for New Normal

It’s becoming a worn-out phrase because, in the end, the more things change, the more they stay the same. We are going to live, shop, drive, work, and play. But how we do these things and where we do these things are changing.

Here’s the rub; Wall Street is cheering about those changes. We have already seen the so-called work from home stocks rocket into the stratosphere. Yesterday, we saw the Street cheer about the announcement from Gap Stores (GPS) that it will close stores across North America over the next few years. By 2023, 80% of its revenue will come from e-commerce and off-mall locations.

That news sent shares of Gap Stores soaring, bringing brick-and-mortar retailers along for the ride.

Another big winner was Southwest Airlines (LUV), which is bringing back the middle seat. While their rivals dither, the nation’s former premier airline is getting back to a new normal.

Priced for Perfection?

Pulte Homes (PHM) posted great financial results that saw results for revenue and earnings come in better than Wall Street consensus. But shares were under pressure throughout the session. It was a frustrating session for shareholders, especially considering more housing data that underscores the boom is only gaining strength.

Recommended

Existing-Home Sales came in at +9.4% month-over-month, and 20.9% from a year ago to an annual rate of 6,540,000.

To see the chart, click here.

The rich get richer, as the biggest percentage changes have occurred in the most expensive price range.

To see the chart, click here.

Earnings Gyrations

We saw a lot of companies post monster results that initially sent shares erupting higher, and then as the session moved along, those gains evaporated. I know it is so frustrating, especially for investors that bought those stocks on the good news. This is also why I often take profits before earnings are released even when I know the business is doing great.

We took profits on Whirlpool (WHR) at $201.00 a share. Yesterday, the stock closed at $193.00 despite a dream quarter. The great news is when these stocks stumble, and when it seems they have done everything right, opportunities are created. But it’s confusing, and it’s a major reason why folks must understand what they own.

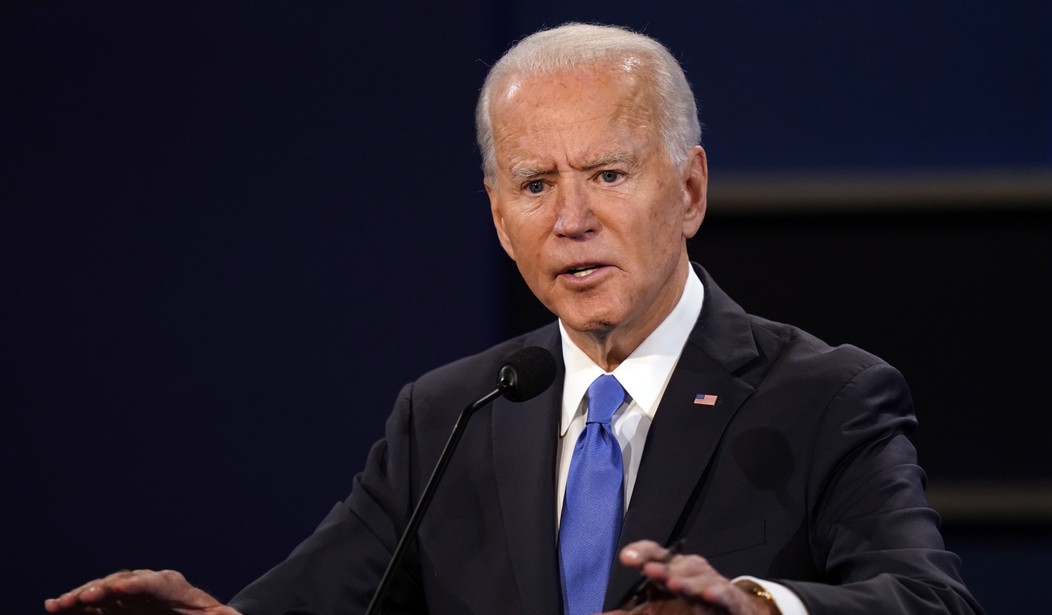

Presidential Debate

I am dismayed that the economy wasn’t the main topic. I think it moved the needle for President Trump, but media headlines and teleprompter scripts were biased before the debate began. I do worry about the hostile tone from Joe Biden when he talked about the stock market. Any attempt to crush the stock market will destroy Main Street.

Over half the homes in the nation own stocks, and it’s still a pretty good proxy for the direction of the overall economy.

Hotline Model Portfolio Approach

Yesterday, we took profits in CAR (Industrials). While we typically do not take a profit in the Hotline Model Portfolio so quickly, it was up +27.2% from the suggested entry in eight days, while the S&P 500 was down -2.0%. If you are not a current Hotline subscriber, call your account representative or email Info@wstreet.com to get started today.

Today's Session

We are going to be on stimulus watch, although there is nearly zero percentage chance, and the pattern of the market is fading quickly after fast starts.

Join the conversation as a VIP Member