Big Blue, otherwise known as IBM, reported a disaster of a quarter this morning, sending its shares lower and crushing the stock market in the process. It should be noted that IBM has been in trouble for quite some time now. Big Blue was slow to jettison poor performing units and slow to be an aggressive buyer in spaces like the cloud. I'm not using IBM as a proxy for the economy, or even tech, or at least not new tech.

Nonetheless, the market is on edge, as it should be during earnings season. In the meantime, the economic backdrop is improving.

Like a lot of the economic data last week, most news outlets, including financial, didn't think much of the 6.3% surge in housing starts. Those that mentioned it, just shrugged it off to more apartments being built, but the story is a lot more than that.

The rate of growth for multi-family is still remarkable, but single family was up month to month, and year over year, and was two-thirds of the total.

| Housing StartsSeptember | One-Family | Multifamily |

| Total | 646,000 | 371,000 |

| Previous Month | 639,000 | 318,000 |

| Year Ago | 582,000 | 281,000 |

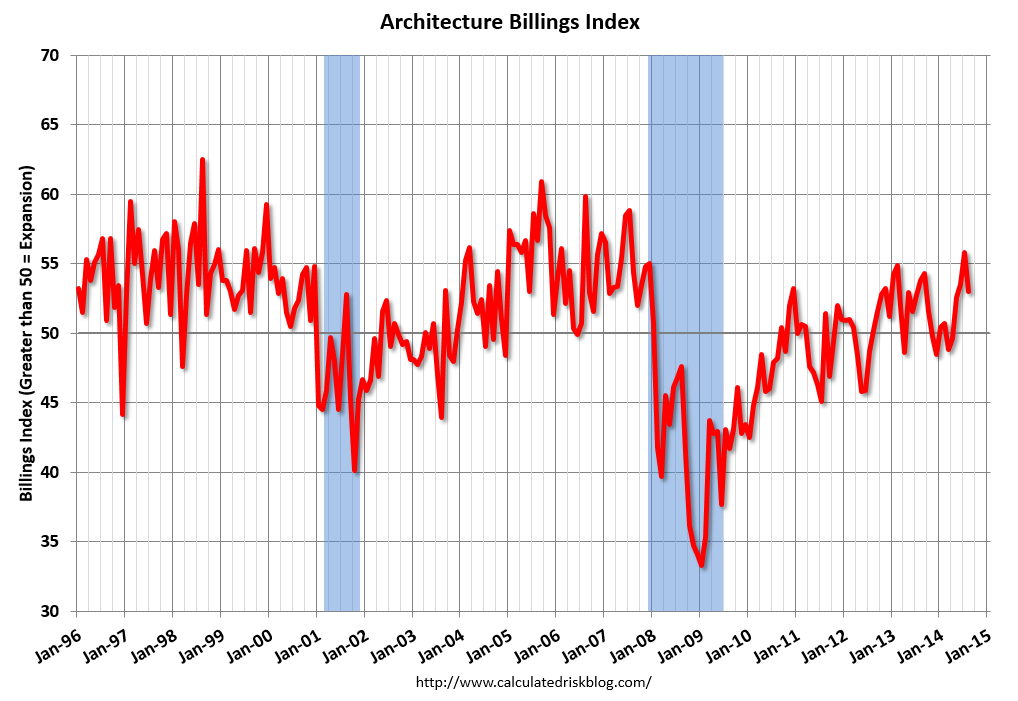

Some say housing data is backwards looking, but one forward looking indicator is the Architecture Billings Index (ABI) and it’s in a great uptrend right now. The index covers inquires and contracts. The number is being driven by multi-family units, but mixed use is strong in institutional projects and commercial projects which are all on the cusp of pre-recession growth.

Recommended

The problem with the economy is that this recovery is where it should have been four years ago, and the key characteristic is the lack of wage growth. On the contrary, wages are lower than the start of the recession. That's only changing slowly as the National Association for Business Economics’ (NABE) quarterly report compiled from leading economists point to not only slow rising wages, but a nice divergence between hiring and firing.

| NABE | |

| Added Headcount | 32% |

| Lowered Headcount | 7% |

| No Problems Finding Workers | 66% |

| Raised Wages | 24% |

Join the conversation as a VIP Member