Market prognosticators love to pin their predictions on specific dates. A correct general market trend prediction doesn’t give the putative clairvoyant the same pizzazz as a bang on market prediction or set of predictions made to coincide with a specific date or dates. The Ides of March (March 15) provide financial market gurus with plenty of historic and current events on which to base predictions, particularly this year. The Ides of March has ominous overtures because it was the date that Julius Caesar was assassinated as foretold by the soothsayer. The death of Caesar was a dramatic event that started the transformation of Rome from a Republic to an Empire. As such, the Ides of March is the perfect date for financial gurus to make their ‘turning point” gloom and doom calls.

This year, according to financial Armageddon types, there were four key events that were projected to fall on the Ides of March that might have spelled economic doom, or at least have given the financial markets a serious jolt, including the Federal Reserve’s interest rate decision, the expiration of the United States debt ceiling, the Dutch Election results and the triggering of Article 50 to start the exit of Great Britain from the European Union.

With the Ides of March past us, how are we holding up?

Key Events of March 15, 2017 Dud or Fireworks:

The Fed Interest Rate Decision

The Federal Reserve’s Open Market Committee Meeting had long been scheduled for March 14-15. A Fed decision to raise rates on the Ides of March was viewed by some as the straw that might break the bull market’s eight year back, leading to the beginning of a sharp market decline and eventual collapse.

On Wednesday, March 15, the Fed announced it was raising the Fed funds rate 25 basis points. The rate hike, however, was not a surprise as the Fed had conditioned the markets over the past month or so to expect it.

Dud or Fireworks? Dud. By the time the Fed announced its rate hike on March 15, market participants fully expected it. There was no massive sell off or panic on Wall Street.

There were fireworks, however, in the gold and silver markets. Both precious metals rose sharply on news of the Fed announcement.

Recommended

Gold

The price of gold popped after the Fed announcement to raise interest rates a quarter of a point.

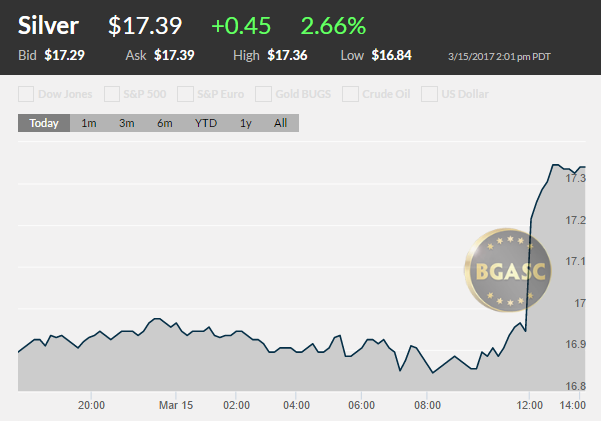

Silver

Silver spiked soon after the Fed decision to raise interest rates.

The equity markets also rose in a manner as if there had been a rate cut.

U.S. Debt Ceiling

The United States federal government’s ability to borrow money to pay obligations expired on March 16. While this situation sounds ominous, U.S. Speaker of the House, Paul Ryan announced on March 15 that the congress did not need to raise the debt ceiling to coincide with the expiration of the federal government’s ability to borrow money. The U.S. Treasury has about $200 billion on hand to pay current obligations, like Social Security and Medicare benefits, military salaries, tax refunds, interest on the national debt and other obligations.

There seems to be no urgency in raising the debt ceiling as Senate Majority Leader Mitch McConnell has promised that Congress will vote to raise the debt ceiling. The U.S. Treasury’s cash on hand, however, will run out sometime in the summer even if it takes extraordinary measures like suspending the issuance of state and local government bonds, refusing to fund federal employee pension plans and halting the issuance of U.S. savings bonds.

Dud or Fireworks? Dud, at least for now. Markets are not paying attention to the outside chance that the U.S. congress would not get the necessary votes to raise the debt ceiling prior to the Treasury running out of cash. In the event Congress does not vote to raise the debt ceiling, the United States would default on its debt and other obligations and then there would be financial fireworks.

Dutch Elections

On March 15, the citizens of the Netherlands went to the polls. Geert Wilder, Dutch Nationalist and his party the PVV had vowed to take the Netherlands out of the EU, close the nation’s mosques and ban the Quran. A Wilder victory, some pundits suggested, would pave the way for a collapse of the EU and give French Nationalist and Presidential candidate Marine Le Pen her aspirations. In such a scenario a populist wave would sweep across the Europe Union spelling doom for the European political union and its currency.

Geert Wilders’ garnered 12% of the vote and his PVV party gained 4 seats, from 15 to 19 while the ruling Liberal party led by Dutch Prime Minister Mark Rutte lost 10 seats, from 41 to 31.

Dud or Fireworks? Dud. Wilder’s 12% showing and the splintering of the Dutch vote among other parties in the Netherlands, all of whom had previously vowed not to form a government with Wilder, ensured there would be no immediate panic about the survival of the European Union and the Euro. The Euro and major European equity market index all rose the day after the election.

Article 50 Trigger

For most of this year, Brexit watchers had expected British Prime Minister Theresa May to trigger Article 50 of the Lisbon Treaty on March 15 and begin the process of extricating Great Britain from the European Union. March 15th has come and gone and the date to trigger Article 50 has been pushed back to sometime towards the end of the month. Prior to triggering Article 50, the Prime Minister wants to tour Wales, Scotland (whose First Minister is not in favor of Brexit). On March 16, the Queen of England signed the Article 50 Brexit bill into law proving a clear path for the Prime Minister to begin talks to negotiate Britain’s divorce from the European Union.

Dud or Fireworks? Dud. While the pound suffered a precipitous fall after the date of the Brexit vote from around $1.50 to the $1.21.-$1.25 range, it has since stabilized there. The economy of Great Britain, however, has proven resilient despite predictions of economic calamity if the leave vote were to prevail.

Future Fireworks?

Economic calamity may one day strike, perhaps even in 2017, but rarely can prognosticators ever pick the exact date on which such events may happen. If we make it through 2017 without an economic crisis, certainly we will hear that the 2018 Ides of March may be something to beware.

This article by BGASC is not, and should not be regarded as, investment advice or as a recommendation regarding any particular course of action.

Join the conversation as a VIP Member