Most Western nations have huge long-run fiscal problems because of unfavorable demographics and misguided entitlement programs.

The good news is that dozens of nations have fully or partially shifted to mandatory private savings as a pro-growth way of modernizing bankrupt tax-and-transfer Social Security  systems.

systems.

But good news in the short run doesn’t mean good news in the long run if greedy politicians decide to loot the wealth accumulated in personal retirement accounts.

That’s already happened in Argentina and Hungary, and now it’s happened in Poland. Here’s part of a Financial Times report about the government stealing money from private pension funds.

Poland’s government on Wednesday took an axe to part of the country’s pension system in a bid to bolster public finances. Premier Donald Tusk said that part of the country’s obligatory pension system run by private funds would be dramatically revamped, with 120bn zlotys ($37bn) in government bonds held by the 14 funds being transferred to the government pension scheme and cancelled… The funds will keep control of the 111bn zlotys they hold in equities and current benchmarks will be loosened. The funds will be banned from investing in more government debt. Tusk said that the millions of Poles currently enrolled in the privatised system would have the choice of staying in the scheme or of transferring their assets into the government-run pension system. Market reaction to the long anticipated move was negative. The Warsaw Stock Exchange, where the private funds, known as OFEs, have a big presence, was down by more than 2 per cent. Yields on 10-year Polish government bonds jumped to 4.75 per cent, the highest in a year.

Is anyone surprised by the “negative” reaction?!? Of course markets are unhappy when politicians arbitrarily seize wealth for short-term political games!

Recommended

Sounds like Poland wants to become the Argentina of Europe. Though there’s always plenty of competition in the contest for bad government policy.

But we do have a bit of good news.

Here is some interesting polling data from an article on the political preferences of young Americans.

…51 percent of Millennials believe that when government runs something it is usually wasteful and inefficient, up from 31 percent in 2003 and 42 percent in 2009: “Hardly a ringing endorsement for a bigger government providing more services.” There’s more: 86 percent of Millennials support private Social Security accounts and 74 percent would change Medicare so people can buy private insurance. Sixty-three percent believe free trade is a good thing. Only 38 percent of Millennials support affirmative action.

Wow, 86 percent of young people support personal retirement accounts. That’s very encouraging, particularly since the general population supports this pro-growth reform by a more-than 2-1 margin.

Here’s a video that explains why a privatized or “personalized” Social Security system is the only way of dealing with the current system’s bankruptcy without screwing younger workers.

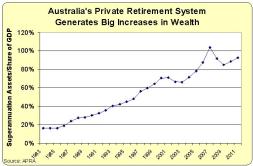

I think the video is a good summary explanation, but I also invite you to look at these two charts, one showing the impressive private wealth being accumulated in Australia thanks to personal retirement accounts and the other showing the staggering future shortfalls for America’s pay-as-you-go Social Security scheme.

If those charts don’t convince you, I suspect you’re a genetic statist.

If those charts don’t convince you, I suspect you’re a genetic statist.

P.S. The thievery of the Polish government is a helpful reminder of why it’s good to have some of your money offshore, preferably managed by a non-US company. After all, does anyone doubt that American politicians are capable of the same venal behavior? They’re probably looking at the money in IRAs and 401(k)s and salivating at the thought of how many votes they could buy with all that money. If (or when) that tragic day arrives, the Americans who have their money beyond the grasp of the federal government will be very happy.

P.P.S. Here’s a good joke about the Social Security system. Except it’s not really a joke because it’s too close to the truth.

P.P.P.S. You can see President Obama’s proposed “solution” the Social Security crisis by clicking here. I don’t think you’ll be surprised to learn that it means a big shift of money from taxpayers to politicians.

Join the conversation as a VIP Member