When I first started working on fiscal policy in the 1980s, I never thought I would consider Sweden any sort of role model.

It was the quintessential cradle-to-grave welfare state, much loved on the left as an example for America to follow.

But Sweden suffered a severe economic shock in the early 1990s and policy makers were forced to rethink big government.

They’ve since implemented some positive reformsin the area of fiscal policy, along with other changes to liberalize the economy.

I even, much to my surprise, wrote a column in 2012 stating that it’s “Time to Follow Sweden’s Lead on Fiscal Policy.”

More specifically, I’m impressed that Swedish leaders have imposed some genuine fiscal restraint.

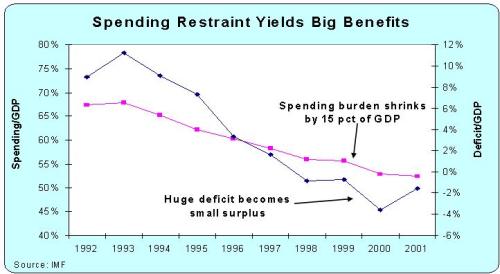

Here’s a chart, based on IMF data, showing that the country enjoyed a nine-year period where the burden of government spending grew by an average of 1.9 percent per year.

From a libertarian perspective, that’s obviously not very impressive, particularly since the public sector was consuming about two-thirds of economic output at the start of the period.

But by the standards of European politicians, 1.9 percent annual growth was relatively frugal.

And since Mitchell’s Golden Rule merely requires that government grow slower than the private sector, Sweden did make progress.

And since Mitchell’s Golden Rule merely requires that government grow slower than the private sector, Sweden did make progress.

Real progress.

It turns out that a little bit of spending discipline can pay big dividends if it can be sustained for a few years.

This second chart shows that the overall burden of the public sector (left axis) fell dramatically, dropping from more than 67 percent of GDP to 52 percent of economic output.

By the way, the biggest amount of progress occurred between 1994 and 1998, when spending grew by just 0.27 percent per year. That’s almost as good aswhat Germany achieved over a four-year period last decade.

Recommended

It’s also worth noting that Sweden hasn’t fallen off the wagon. Spending has been growing a bit faster in recent years, but not as fast as overall economic output. So the burden of spending is now down to about 48 percent of GDP.

And for those who mistakenly focus on the symptom of red ink rather than the underlying disease of too much spending, you’ll be happy to know that spending discipline in the 1990s turned a big budget deficit (right axis) into a budget surplus.

Now let’s get the other side of the story. While Sweden has moved in the right direction, it’s still far from a libertarian paradise. The government still consumes nearly half of the country’s economic output and tax rates on entrepreneurs and investors max out at more than 50 percent.

And like the United Kingdom, which is the source of many horror stories, there are some really creepy examples of failed government-run health care in Sweden.

- A man who had his penis amputated because he was first misdiagnosed and then forced to wait five months for a follow-up examination.

- Another man was forced to stitch up his own leg after a lengthy wait for medical treatment – and he then had to deal with insult added to injury when the bureaucrats reported him violating rules.

- And another man with no legs was denied a motorized wheelchair because the government ruled that he didn’t necessarily have a permanent condition.

Though I suppose if the third man grew new legs, maybe we would all reassess our views of the Swedish system. And if the first guy managed to grow a new…oh, never mind.

But here are the two most compelling pieces of evidence about unresolved flaws in the Swedish system.

First, the system is so geared toward “equality” that a cook at one Swedish school was told to reduce the quality of the food she preparedbecause other schools had less capable cooks.

Second, if you’re still undecided about whether Sweden’s large-size welfare state is preferable to America’s medium-size welfare state, just keep in mind that Americans of Swedish descent earn 53 percent morethan native Swedes.

In other words, Sweden might be a role model on the direction of change, but not on the level of government.

P.S. On a separate topic, regular readers know that I’m a fan of lower taxesand a supporter of the Second Amendment. So you would think I’d be delighted if politicians wanted to lower the tax burden on firearms.

This is not a hypothetical issue. Here’s a passage from a local news report in Alabama about a state lawmaker who wants a special sales tax holiday for guns and ammo.

Rep. Becky Nordgren of Gadsden said today that she has filed legislation to create an annual state sales tax holiday for gun and ammunition purchases. The firearms tax holiday would occur every weekend prior to the Fourth of July. Alabama currently has tax holidays for back-to-school shopping and severe weather preparedness. Nordgren says the gun and ammunition tax holiday would be a fitting way to celebrate the anniversary of the nation’s birth and Alabama’s status as a gun friendly state.

I definitely admire the intent, but I’m enough of a tax policy wonk that the proposal makes me uncomfortable.

Simply stated, I don’t want the government to play favorites.

For instance, I want to replace the IRS in Washington with a simple and fair flat tax in part because I don’t want the government to discriminate based on the source of income, the use of income, or the level of income.

And I want states to have the lowest-possible rate for the sales tax, but withall goods and services treated equally. Alabama definitely fails on the first criteria, and I wouldn’t be surprised if it also granted a lot of loopholes.

So put me in the “sympathetic skepticism” category on this proposal.

Though I imagine this Alabama lass could convince me to change my mind.

P.P.S. A few days ago, the PotL noticed that I shared some American-European humor at the end of a blog post. She suggests this would be a good addition to that collection.

I can’t comment on some of the categories, but I will say that McDonald’s in London is just as good as McDonald’s in Paris, Milan, Geneva, and Berlin.

Join the conversation as a VIP Member