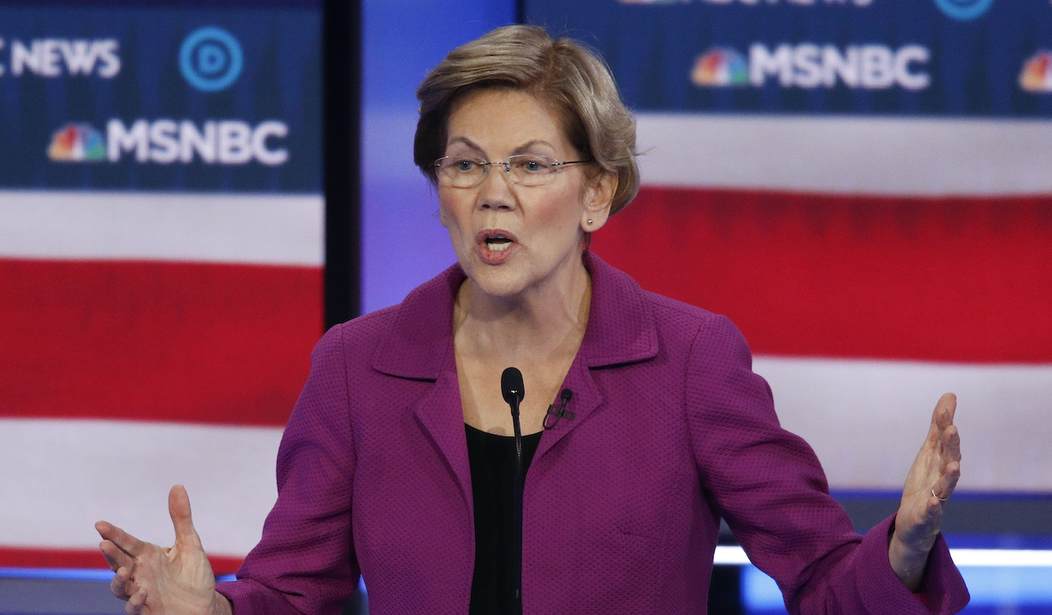

Senator Elizabeth Warren (D-MA) re-upped her call for the implementation of a “wealth tax” on the highest earners, which she previously made a center-stage legislative promise in her presidential campaign.

Warren’s proposal, named the Ultra Millionaire Tax Act, would impose a 2 percent tax on those earning between $50 million and $1 billion annually, and a 1 percent surtax, totaling to 3 percent, on individuals earning more than $1 billion per year.

The Massachusetts Democrat railed against the “ultra rich and powerful,” who are targeted by Warren’s proposed tax increase.

"The ultra-rich and powerful have rigged the rules in their favor so much that the top 0.1% pay a lower effective tax rate than the bottom 99%, and billionaire wealth is 40% higher than before the COVID crisis began. A wealth tax is popular among voters on both sides for good reason: because they understand the system is rigged to benefit the wealthy and large corporations," said Warren. "As Congress develops additional plans to help our economy, the wealth tax should be at the top of the list to help pay for these plans because of the huge amounts of revenue it would generate."

Warren: “it is time for a wealth tax in America” pic.twitter.com/th68Ys0xrd

— Burgess Everett (@burgessev) March 1, 2021

Recommended

The bill is endorsed by a host of far-left groups that are in favor of raising taxes on the highest earners. It is estimated that 100,00 families will be subject to the tax, though it's unlikely to garner sufficient support in the Senate.

White House Press Secretary Jen Psaki said that President Biden “is aligned” with Warren’s greater goal, but did not firmly commit the president’s support or opposition to her legislation.

Asked @PressSec if Biden has appetite for @SenWarren's wealth tax.

— Philip Melanchthon Wegmann (@PhilipWegmann) March 1, 2021

"He has a lot of respect for Sen. Warren and is aligned on the goal of ensuring the ultra wealthy and big corporations finally pay their fair share."

No commitment but she said he expects to work with Warren.

Join the conversation as a VIP Member