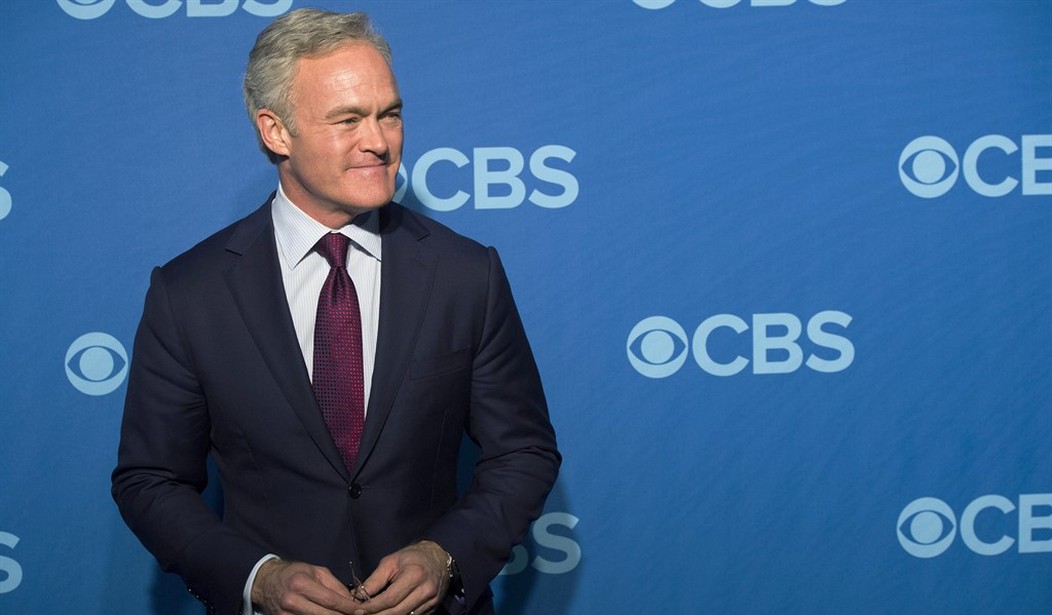

On February 4, 2024, 60 Minutes’ Scott Pelley interviewed Federal Reserve Bank Chairman, Jerome Powell. Topics included inflation risks and the U.S. economy, the timeline for cutting U.S. Federal Funds Rate, the current health of U.S. banks, and Powell’s compelling admission that the Fed erred in declaring mid-2021 inflation to be transitory and missed tell-tale signs of Silicon Valley Bank’s insolvency.

However, Mr. Pelley’s most impressive feat was getting Chairman Powell to express his concern over U.S. fiscal policy and our growing national debt, something that he has heretofore resisted as chairman of the Federal Reserve. Pelley cited the terrifying claim that in just 30 years the U.S. national debt is projected to be $144 trillion or $1 million per household.

Pelley then asked, “How do you assess the national debt?” Powell was deferential, explaining that it is not the Fed’s job to instruct Congress on how to manage fiscal policy. But on further questioning, Powell responded boldly and uncharacteristically, “In the long run, the U.S. is on an unsustainable fiscal path [because] the debt is growing faster than the economy.” We are borrowing from future generations and have gotten off the path of fiscal sustainability. But the economy, Powell argued, is dynamic, innovative, flexible, and adaptable. Its strength has also enabled us to defend democracy and global economic security.

Powell’s statement was refreshing because it indicated that we may, finally, be ready to have a serious conversation on debt. We have trod this path for more than 40 years. It’s time to confront the debt load being not sustainable.

The Evidence

In 1981, our national debt was just 31.1% of U.S. GDP, with the U.S. national debt at $998 billion and U.S. GDP at $3.21 trillion. Forty-three years later, we have ignored every call to reduce the debt and get our fiscal house in order. For the fiscal year ending September 30, 2023, the U.S. national debt of $31.17 trillion was at an alarming 114% of America’s $27.36 trillion GDP. While U.S. GDP has increased by 7.52 times since 1981, our national debt has increased over 30 times in the same period! It’s time to take the advice of John Maxwell, who noted that a man must be “big enough to admit his mistakes, smart enough to profit from them, and strong enough to correct them.”

Recommended

Excessive government spending and record-high deficits during pre-Hitler Germany’s Weimar Republic imposed high taxes and hyperinflation, collapsing one of the largest and most prosperous economies of its time. Germany’s problem became a world problem as an otherwise wise and peaceful populace elected a tyrant who unleashed devastation on much of the world. Similar fiscal and monetary mismanagement plunged much of the world into chaos when the Roman Empire fell in 476 A.D.

What cost would the loss of the order brought by a collapse of the United States economy impose on the world?

Why we must act now

According to the U.S. Treasury, our national debt is now just over $34.2 trillion, or $264,945 per taxpayer. It took more than two centuries from 1776 to record a total national debt of $1 trillion but only 29 additional years to grow it to $13.5 trillion in 2010. In less than 14 years, our national debt grew to more than $34.2 trillion — with over half the current fiscal year yet to be recorded. Now at 122.72% of GDP, with more than $800 billion in interest payments on treasury bonds and treasury bills to finance the deficit, interest on the national debt is the fourth largest item in the federal budget. Only Medicare/Medicaid programs, Social Security, and our national defense take up more.

Stopping the Insanity

For more than a decade we financed this monstrous debt at interest rates below 2%. As of October 2023, the new blended average interest rate reflects our 40-year high spike in inflation, at roughly 3.05%, and is likely to go higher. By the end of our current fiscal year or next, we predict Americans will have paid annually more than $1.0 trillion in interest on the debt — roughly double the interest burden of the fiscal year 2021-22. If our prediction comes true, interest on the national debt will become the third largest item in the federal budget. How long before it becomes the largest?

Powell has admitted the problem. Now, we must gather the strength to correct it. Raising taxes is not the solution. The National Taxpayers Union explains that the top 1% of income earners in America paid 45.78% of all personal income taxes generated in the United States in 2021. How much more can we ask of them?

Higher taxes discourage production and drive productivity to countries with lower taxes. Only lower taxes and sensible regulations can grow the economy and increase our tax revenue. More importantly, we must cut spending. Forty nine of 50 states are required by law to balance their budgets. Is it time for a national balanced budget amendment?

Chairman Powell recognized that America has been one of the world’s freest economies. The nation’s greatness lies in its moral character, the rule of law, and a meritocracy where success requires satisfying customers. We attract entrepreneurs who have made America the world’s leader in invention and innovation, a laboratory for new ideas, and the production of first-order goods, services, and assets.

Now innovating in artificial intelligence, the American economy has moved beyond just manufacturing to become home to the Magnificent Seven companies (Apple, Microsoft, Google/Alphabet, Amazon.com, Nvidia, Meta Platforms, and Tesla). Hydraulic fracturing has supplied the energy for the tech revolution, making America the largest producer of oil and natural gas (the cleanest in the world) and the cleanest coal. Sound U.S. regulatory, fiscal, and monetary policy must help to drive U.S. GDP growth. At the same time, reasonable government spending is based on sound budget practices that force the government to live within its means.

Where will America be if the world calls?

President George H.W. Bush was able to finish what President Reagan began, bankrupting the Soviet Union, because America could withstand a $290 billion deficit in 1992 ($635 billion in inflation-adjusted dollars in 2023). Even that is far below the $1.7 trillion Federal budget deficit realized in the fiscal year ending September 30, 2023. Let's also not forget that the United States and its allies demanded the unconditional surrender of the Axis powers because we were able to back that demand. The nation would field war materials and troops, bringing the national debt to 119% of U.S. GDP at the end of World War II because of the belief in a post-World War II American economy.

Will the US Congress have the financial strength and confidence from American voters to allocate $4.7 trillion as they have since early 2020 to fight a new pandemic? (Since early 2020, Congress has spent $4.4 trillion, while $4.6 trillion of the $4.7 trillion total has been obligated, according to USAspending.gov).

We are faltering in our commitment to Israel and Ukraine, and even bigger threats loom over economic powerhouses Taiwan, Japan, and South Korea. The only escape in such crises might be inflation, which will forever cost us the confidence of the world economy as the world’s reserve currency.

Americans deserve better than to be led by a government of profligate spenders. The refusal to confront the national debt will rob us and the world of the greatest impetus to human progress and security since the 1800’s…the American Competitive Free Enterprise System.

About the Authors

Dr. Timothy G. Nash, director, McNair Center, Northwood University. Mr. Jason Hayes, director of Energy and Environmental Policy, Mackinac Center. Senator George Lang, chairman, Business First Caucus, Ohio State Legislature. Mr. Tom Rastin, retired Ohio business executive.

Join the conversation as a VIP Member