Editor's Note: This column is co-authored by Timothy Nash and Ohio State Sen. George Lang.

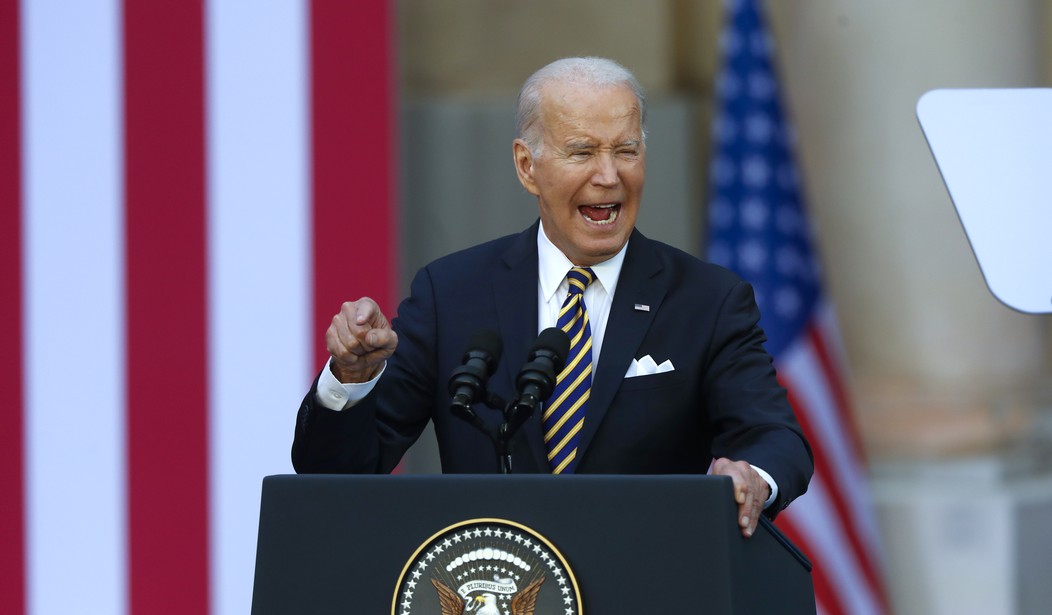

Earlier this year, The Wall Street Journal coined the term Bidenomics to expose the administration’s overstatement of success and understatement of problems in the U.S. economy. President Biden now uses Bidenomics as a re-election campaign talking point to portray a robust U.S. economy as the best, if not among the best, economies in the world. For example, in June of 2022, on Jimmy Kimmel Live!, President Biden said: “Look, here’s where we are. We have the fastest-growing economy in the world. The world. The world.” In a January 2023 speech in Springfield, Virginia, President Biden stated, “the economy is growing strong.”

With obvious disagreement over the performance of the U.S. economy since January of 2021, we ask the pivotal question “Will the real Bidenomics, please stand up”?

Please consider the following points:

Bright Spots. Among the brightest spots in the Biden economy are the major stock indices and job creation. The Dow Jones Industrial Average (DJIA), The NASDAQ, and the S&P 500 have all experienced impressive growth in 2023, with the broad-based S&P 500 closing last week up 29% from its 52-week low of 3,491.58. Job growth under President Biden has seen the total number of Americans working climb from 150.239 million in February 2021 to 160.994 million according to the Bureau of Labor Statistics (BLS) June 2023 jobs data report, resulting in an impressive net gain of 10.755 million jobs.

A Closer Look at Job Growth. In December of 2019, 158.803 million Americans were employed but dropped below 135 million in April of 2021 due to the COVID-19 Pandemic. A spectacular jobs recovery took place in the second half of 2020 with over 150 million Americans employed as the Trump administration ended. The job growth and near record unemployment rate of 3.6% under the Biden administration is impressive. However, most of the jobs added to the U.S. economy have been previously held jobs recovered from the ill-effects of the COVID-19 recession, and not new jobs created.

Recommended

GDP Growth. The U.S. economy experienced two of the worst back-to-back quarters of GDP decline in the first half of 2020 due to the COVID-19 recession, followed by among the most spectacular back-to-back quarters of GDP growth in American history (Q3: 35.3% and Q4: 3.9%) - a rebound most American economists did not expect. The U.S. economy grew at an impressive 5.9% in 2021. However, it was far from being "the fastest-growing economy in the world." In fact, the U.S. trailed more than 50 countries in 2021 GDP growth with Ireland (13.5%), Chile (11.7%), Turkey (11%), India (8.7%), China (8.1%), and the United Kingdom (7.4%) leading the way. Next, the Organization for Economic Cooperation and Development (OECD) forecasted strong growth for the global economy in 2022 for several of its key members including Saudi Arabia (7.8%), India (6.9%), Indonesia (4.7%), China (4.4%), Australia (4.2%), and the US (2.5%). While the prediction of 2.5% GDP growth in 2022 represented a dramatic decline from 2021, the U.S. economy in fact grew at an even more disappointing 2.1% in 2022 with Q1 and Q2 registering negative GDP growth (Q1: -1.6% and Q2: -0.6%). The current U.S. economy is growing at 2%, with the Conference Board predicting negative GDP growth for the second half of 2023.

Inflation. When President Biden took office on January 20, 2021, the U.S. inflation rate was 1.4%. As inflation increased to 4.2% in April of 2021, the President and many cabinet members declared inflation to be transitory and not a problem. President Biden refused to link inflation to the increase in the money supply as measured by the Federal Reserve Balance Sheet from $7.45 trillion in January of 2021 to almost $9 trillion by March of 2022. He also refused to correlate spending programs he initiated that added more than $3 trillion to the U.S. economy in 2021 related to COVID-19 relief, infrastructure, and green energy programs. The Federal Reserve has since noted inflation was not transitory, and it waited too long to combat inflation. This egregious error forced the Federal Reserve to act harshly to combat inflation. Government monetary policy has taken the Federal Funds Rate from just over 0 in March of 2022 to over 5.25% currently. Key market interest rates have risen dramatically, slowing the U.S. economy, and making it very difficult for consumers. For example, in the spring of 2022, a consumer could have purchased an automobile on a 7-year payment plan at 2% interest; that same loan today will cost roughly 7%. For a person with good credit, a 30-year fixed mortgage rate was 2.9% in July 2021, 5.3% in July 2022 and 6.81% nationally in July 2023. Many economists predict things will only get worse before they get better with record credit card interest rates adding to the financial problems many consumers face today.

Rising Consumer Debt. According to the Federal Reserve Bank of New York, at the end of Q1 2023 U.S. consumer debt was at or near record levels in numerous categories. Total U.S. household debt was at $17.05 trillion, mortgage debt was $12.04 trillion, auto loan debt was $1.56 trillion, student loan debt was $1.78 trillion and U.S. credit card debt were $986 billion. According to a June PRIMERICA report, over the last few months, 36% of all Americans were dependent on credit cards to pay off debts and 37% of middleclass Americans had dipped into their 401K’s incurring tax penalty costs to make debt payments. After the recent U.S. Supreme Court decision on student loans, things are only going to get worse for many consumers, as roughly 37 million Americans must resume making student loan payments that average roughly $250 a month, beginning in October.

Are Red States Making the Biden Economy Look Better?

According to a recent article in The Wall Street Journal, U.S. Aggregate Earnings Growth for Q1 2022 to Q1 2023 was 5.4% for the United States overall. However, many blue states underperformed, including Oregon (4.5%), California (2.9%), Illinois (4.6%), New York (2.6%), New Jersey (4.3%), and Maryland (4.0%). Many red states helped make up for the sluggishness in other state economies with exceptional Aggregate Earnings Growth: South Carolina (8.0%), Florida (9.1%), North Dakota (9.7%), Nebraska (8.6%), Texas (7.7%), and Alaska (7.9%). A closer look at the performance of the red states will find a much more friendly business and tax regulatory environment.

Conclusion

On Inauguration Day, 2021, President Biden inherited a $27.59 trillion national debt. The current U.S. national debt stands at $32.552 trillion and growing. We believe government spending is out of control and needs to be reined in. We also believe the U.S. economy needs to unleash its energy sector to realize U.S. energy independence, while offering competitive U.S. energy alternatives to freedom-loving economies around the world. A global economy with the United States as the leading producer of oil and natural gas is a much stronger, safer, stable, and more vibrant economy than what we face today.

We encourage President Biden to closely examine the states that have been top economic performers since his election. He will find that most have been “friendly” to business with low taxes and a regulatory environment that is attractive to creating jobs and expanding job growth. Bidenomics could be greatly improved by following the tax and fiscal policy of the high-performing U.S. states noted above.

Dr. Timothy G. Nash is senior vice-president emeritus and director of The McNair Center at Northwood University. Mr. George Lang is state senator from Ohio’s 4th senatorial district and co-chairs Ohio’s Business First Caucus.

Join the conversation as a VIP Member