Back in the 1960s, Clint Eastwood starred in a movie entitled The Good, the Bad and the Ugly.

I was thinking that might be a good title for today’s post about some new research by Michelle Harding, a tax economist for the OECD. But then I realized that her study on “Taxation of Dividend, Interest, and Capital Gain Income” doesn’t contain any “good” news.

At least not if you want the United States to be more competitive and create more jobs. This is because the numbers show that the internal revenue code results in punitive double taxationof income that is saved and invested.

At least not if you want the United States to be more competitive and create more jobs. This is because the numbers show that the internal revenue code results in punitive double taxationof income that is saved and invested.

But it’s not newsworthy that there’s a lot of double taxation in America. What is shocking and discouraging, however, is finding out that our tax code is more punitive than just about every European welfare state.

This is the “bad” part of today’s discussion. Indeed, the tax burden on dividends, interest, and capital gains in America is far above the average for other industrialized nations.

Recommended

Let’s look at some charts from the study, starting with the one comparing the tax burden on dividends.

As you can see, the United States has the dubious honor of having the sixth-highest overall tax rate (combined burden of corporate and personal taxes) among developed nations.

Though maybe we should feel lucky we’re not in France or Denmark.

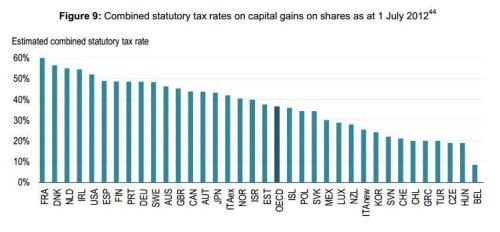

The next chart looks at the tax burden on capital gains.

Once again, the United States has one of the most onerous tax systems among OECD countries, with only four other nations imposing a higher combined tax rate on capital gains.

By the way, if you want to know why this is a very bad idea, click here.

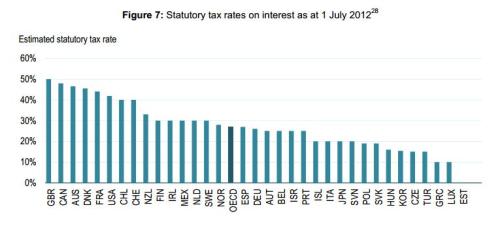

Last but not least, let’s look at the tax burden on interest.

I’m sure you’ve already detected the pattern, but I’ll state the obvious that this is another example of the United States being on the wrong side of the graph.

So the next time you hear somebody bloviating about Americans being too short-sighted and not saving enough, you may want to inform them that there’s not much incentive to save when the IRS gets a big share of any interest we earn.

Not that any of us are getting much interest since the Fed’s easy-money policyhas created an atmosphere of artificially low interest rates, but that’s a topic for another day.

Let’s now move to the “ugly” part of the analysis.

Some of you may have noticed that the charts replicated above are based on tax laws on July 1, 2012.

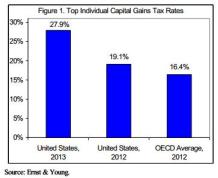

Well, thanks to Obamacare and the fiscal cliff deal, the IRS began imposing higher tax rates on dividends, capital gains, and interest on January 1, 2013.

Well, thanks to Obamacare and the fiscal cliff deal, the IRS began imposing higher tax rates on dividends, capital gains, and interest on January 1, 2013.

And because of the new surtax on investments and the higher tax rates on dividends and capital gains, the United States will move even further in the wrong direction on the three charts.

I don’t know if that means we’ll overtake France in the contest to have the most anti-competitive tax treatment of dividends and capital gains, but it’s definitely bad news.

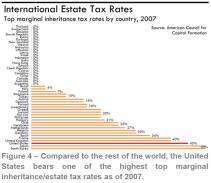

Oh, and let’s add another bit of “ugly” news to the discussion.

The OECD study didn’t look at death tax rates, but a study by the American Council for Capital Formation shows that the United States also has one of the world’s most punitive death taxes.

Even worse than France, Greece, and Venezuela, which is nothing to brag about.

I don’t want to be the bearer of nothing but bad news, so let’s close with some “good” news. At least relatively speaking.

It’s not part of the study, but it’s worth pointing out that the overall burden of taxation – measured as a share of GDP – is higher in most other nations. The absence of a value-added tax is probably the most important reason why the United States retains an advantage in this category.

Needless to say, this is why we should fight to our last breath to make sure this European version of a national sales tax is never imposed in America.

P.S. One of the big accounting firms, Ernst and Young, published some research last year that is very similar to the OECD’s data.