WASHINGTON - President Trump and Republican lawmakers have plenty of legislative disagreements, but there is one issue that entirely unites them: tax cuts.

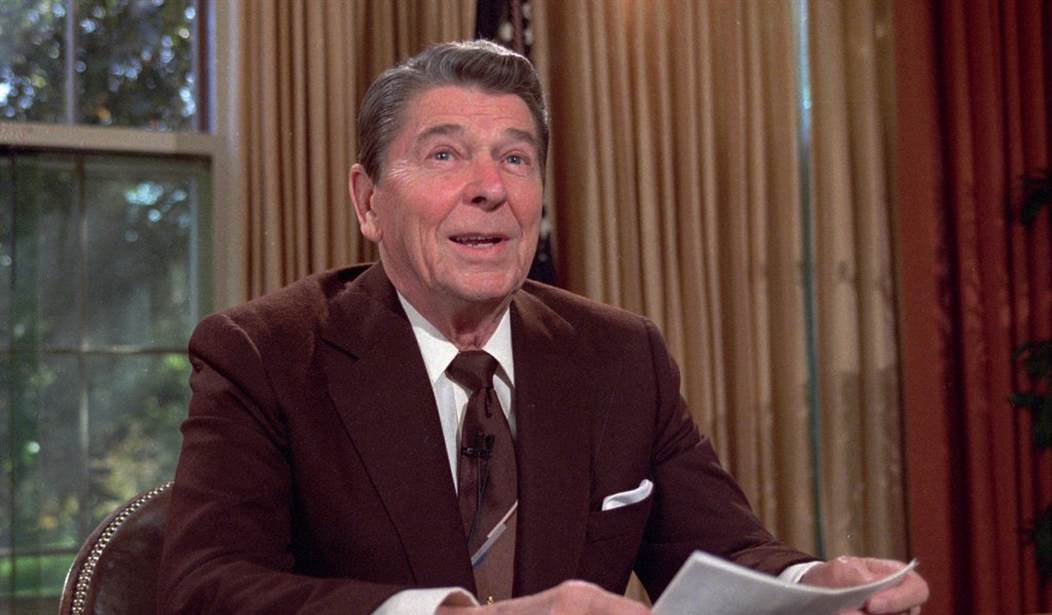

It isn’t getting the fullest attention it deserves from the liberal news media here, but there hasn’t been this much unity among Republicans on a transformative economic issue since Ronald Reagan.

Trump has become much more focused on his tax cut agenda in recent weeks and drawing strong reviews from the GOP’s establishment economists — from Lawrence Kudlow, one of the GOP’s chief voices on economic policy, to Kevin Hassett, formerly with the American Enterprise Institute, who is now the president’s economic adviser.

“Trump has seized and energized the tax cut issue,” Kudlow wrote this week in his newspaper column. “Almost daily, he is pounding away on the themes of faster economic growth and more take-home pay, arguing that his plan will make America’s economy great again.”

“This is Trumpian leadership at its best,” he said.

For much of this year, Trump has talked about his economic revival plan in generalities. But lately, he has been amplifying his rhetoric and discussing the impact of the tax cuts with more specifics, as he did this week at his White House news conference and in his speeches.

“Under my administration, the era of economic surrender is over,” he told the National Association of Manufacturers.

Trump’s first targets were those businesses that moved to countries like Ireland to profit from lower tax rates.

“We will eliminate the penalty on returning future earnings back to the United States, and we will impose a one-time low tax on money parked overseas so it can be brought back home to America where it belongs,” he said in a speech in Harrisburg, Pa. last week.

He also shot back at Democrats who said his tax plan would mostly benefit rich Americans, reminding them that Democrats passed a similar plan proposed by President Kennedy to, as JFK put it, “get America moving again.”

Recommended

Trump would do well to remind Democratic leaders who are playing the tax-cuts-for-the-rich card just as they did in the 1960s, to remember Kennedy’s response: “A rising tide lifts all boats.”

Kennedy never lived to see his tax cuts enacted when President Lyndon Johnson pushed it through a Democratic Congress, producing a wave of stronger economic growth and increased tax revenue to boot.

Democrats never talk about the Kennedy tax cuts, nor do they mention President Clinton’s capital gains tax cuts that led to an explosion of growth in the high tech industry, and a sharp increase in capital gains tax revenue, too.

It violates their sacred oath to always seek higher tax rates to pay for higher government spending levels, which always results in anemic economic growth, lower incomes, and a weak job market.

Trump adviser Kevin Hassett is telling fellow economists that if companies had not moved their profits overseas, the median household income would have grown by $4,000 over eight years.

Some economists doubt his figures, but others say that Hassett’s numbers are close to the mark. And Trump has been using them in his speeches.

“When the U.S. has a more competitive tax system and we reduce the amount of profit-shifting, it makes sense to me that wages will be higher,” University of Maryland economist Phillip Swagel told the Washington Post.

The U.S. economy runs on capital and when tax rates are cut that frees up more capital for investment, new jobs, business expansion, and higher incomes.

When President Reagan cut tax rates across the board in 1981 in the face of a severe recession, the economy was up and running two years later.

By 1983 the economy was growing by 3.2 percent in the second quarter, 5.6 percent in the third, and 7.7 percent in the fourth.

In 1984, quarterly GDP figures were up by 8.5 percent, 7.9 percent, 6.9 percent and 5.8 percent, according to the U.S. Commerce Department and the Federal Reserve. He won re-election by carrying 49 states.

Trump is following Reagan’s footprints with largely the same kind of economic policies. Reducing the number of income tax rates from seven to three brackets, cutting the tax rates in each, and lowering the corporate tax rate from 35 percent to 20 percent.

Earlier this week, Larry Kudlow sent this message to Republican lawmakers:

“Play hardball, GOP. JFK did it. Reagan did it. And now you have Donald Trump doing it…”

If the Republicans can deliver their tax cut bill, Trump will sign it in a New York minute. Then watch this economy soar.

Join the conversation as a VIP Member