There’s a tendency in public life to exaggerate the positive or negative implications of any particular policy.

This is why I try to be careful not to overstate the potential benefits of reforms I like, such as the flat tax. Yes, we would get better growth and there would be less corruption in Washington, but tax reform would not be a panacea for every ill. Many other policies also need to be fixed to generate sustained prosperity.

Likewise, I’m obviously not a fan of Obamacare, but I try to remind people that our system was already messed up even before Obama was elected. As such, repealing Obamacare – while the right thing to do – is just one of many things that need to happen to restore a competitive and efficient healthcare system.

Now that I’ve warned about the risks of overstatement, I’m going out on a limb to say that we may be at the point where France is taxing itself to the point of economic ruin.

One French budget expert warned that, “the spiraling welfare debt was particularly abnormal and particularly dangerous” and that “The strategy of fixing the system by collecting new revenue is reaching its limits.”

One French budget expert warned that, “the spiraling welfare debt was particularly abnormal and particularly dangerous” and that “The strategy of fixing the system by collecting new revenue is reaching its limits.”

And even a European Union Commissioner thinks France has gone too far. As one newspaper reported, “Tax increases imposed by the Socialist-led government in France have reached a ‘fatal level’, the European Union’s commissioner for economic affairs said today. Olli Rehn warned that a series of tax hikes since the Socialists took power…threatens to ‘destroy growth and handicap the creation of jobs’”

You know you’re taxing too much when even Euro-crats in Brussels think the fiscal burden is excessive!

I’ve certainly added my two cents to this discussion, but I suspect people will be more willing to believe someone who endures the French fiscal regime every day.

Recommended

And that’s our topic for today. A woman from France has written a very powerful indictment of France’s coercive and confiscatory economic system. Here are some excerpts from the UK-based Telegraph.

More than 70 per cent of the French feel taxes are “excessive”, and 80 per cent believe the president’s economic policy is “misguided” and “inefficient”. …Worse, after decades of living in one of the most redistributive systems in western Europe, 54 per cent of the French believe that taxes – of which there have been 84 new ones in the past two years, rising from 42 per cent of GDP in 2009 to 46.3 per cent this year – now widen social inequalities instead of reducing them.

Some of you may be wondering why French voters elected a socialist if they overwhelmingly think taxes are too high, but keep in mind that the former President was just as much of a statist.

I’m curious, by the way, about the data on taxes and social equality. Why do the French think higher taxes increase inequality? Is it that they think the higher taxes are being imposed on the middle class and the poor? Do they think that high taxes stifle growth and prevent upward mobility? Is it some combination of these factors, or something else altogether?

One thing we can say with certainty is that all these taxes have led to a bloated public sector.

One thing we can say with certainty is that all these taxes have led to a bloated public sector.

By 2014, France’s public expenditure will overtake Denmark’s to become the world’s highest: 57 per cent of GDP. In effect, just to keep in the same place, like a hamster on a wheel, and ensure that the European Central Bank in Frankfurt isn’t too unhappy with us, Hollande now needs cash. …finance minister Pierre Moscovici recently admitted that he “understood” the French’s “exasperation” with their heavy tax burden. This earned him a sharp rap on the fingers from the president… “It’s not only that people don’t like to be treated like criminals just because they’re successful,” says a French banker friend who has recently moved to London. “But this uncertainty in every aspect of the tax system means it is impossible to do business: you don’t know what your future costs are, or your customer’s. You can’t buy, you can’t sell, you can’t hire, you can’t fire.”

Not surprisingly, this hostility to achievement is having a predictable impact.

…tax has been the clincher that sent hundreds, possibly thousands of French citizens abroad: not just “the rich”, whom Hollande, during his victorious campaign, said he personally “disliked”, …but also the ambitious young, who feel that their own country will turn on them the minute they achieve any measure of personal success. …one out of four French university graduates wants to emigrate, “and this rises to 80 per cent or 90 per cent in the case of marketable degrees”, says economics professor Jacques Régniez, who teaches at both the Sorbonne and the University of New York in Prague. “In one of my finance seminars, every single French student intends to go abroad.

Heck, a majority of French people have said they would be interested in escaping to the United States if they had the opportunity.

However, those are the productive and ambitious young people of France. Unfortunately, there’s another group of young French people, and they have different dreams.

…young people, and many of their parents, dream of getting any kind of state or local administration post…which ensures complete job security, unrelated to the economic situation, the market, or their own performance. More than a quarter of the French workforce is employed by some public body or other: schools, hospitals, local and regional councils, the police, the civil service proper – or those new subsidised public-service jobs the Hollande government is so keen on.

We have people like that in the United States as well.

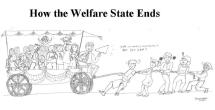

What matters for a society, though, it whether there are too many people living off the government. When the moochers and looters outnumber (and out-vote) the people who are producing, the conditions exist for an economic death spiral.

Simply stated, the folks riding in the wagon keep voting to impose heavier burdens on those pulling the wagon. That eventually leads to economic ruin, and it leads to trouble even faster when thepeople pulling the wagon have the opportunity to move across borders.

Simply stated, the folks riding in the wagon keep voting to impose heavier burdens on those pulling the wagon. That eventually leads to economic ruin, and it leads to trouble even faster when thepeople pulling the wagon have the opportunity to move across borders.

Which is what is happening in France.

P.S. Here’s a powerful comparison of France and Switzerland.

P.P.S. More than 8,000 French households last year got to experience theObama-version of a flat tax.

P.P.P.S. Americans shouldn’t feel superior to France since our tax code is worse in certain ways.

P.P.P.P.S. That being said, we’re not as bad as France, and even Obama won’t be able to change that.

P.P.P.P.P.S. I endorsed the current socialist President of France, but for a strategic reason.

Join the conversation as a VIP Member