One of the difficulties of devising social safety net programs is dealing with what are called "welfare cliffs" - as low-income people move up the income ladder, they see government benefits phase out. Many of these welfare benefits, like the Earned Income Tax Credit, are administered through the tax code. That results in sky-high effective marginal tax rates. There are a few different ways to try to mitigate this, but it's certainly not clear that the federal government is doing it correctly.

The Congressional Budget Office analyzed marginal tax rates that affect different income levels under 2012 tax law and found that people just above and below the poverty line in America can face the highest marginal tax rates:

What this means is that there are massive work disincentives for Americans who are just working themselves out of poverty. As the Heritage Foundation's Salim Furth wrote:

...futility of work for a single parent with one child[:] If he does not work at all, he receives $19,300 in government benefits. If he instead earns a salary of $30,000—which is full-time work at $15 per hour—he has disposable income of $28,000. This means that he is working full-time for only $8,700 per year more than if he did not work at all, making his effective take home wage $4.35 per hour ($8,700/2,000 hours per year). Is it rational to expect someone to work hard for such a low wage?

And Furth had an accompanying chart similar to the CBO's:

This is largely a function of the welfare state, but it's illustrated nicely by the fact that so much of our welfare state spending is now done through the tax code. The Tax Policy Center had a good report, "The War on Poverty Moves to the Tax Code," [pdf] explaining this - you can see the rise of tax code welfare policy like the Earned Income Tax Credit:

.

.

Recommended

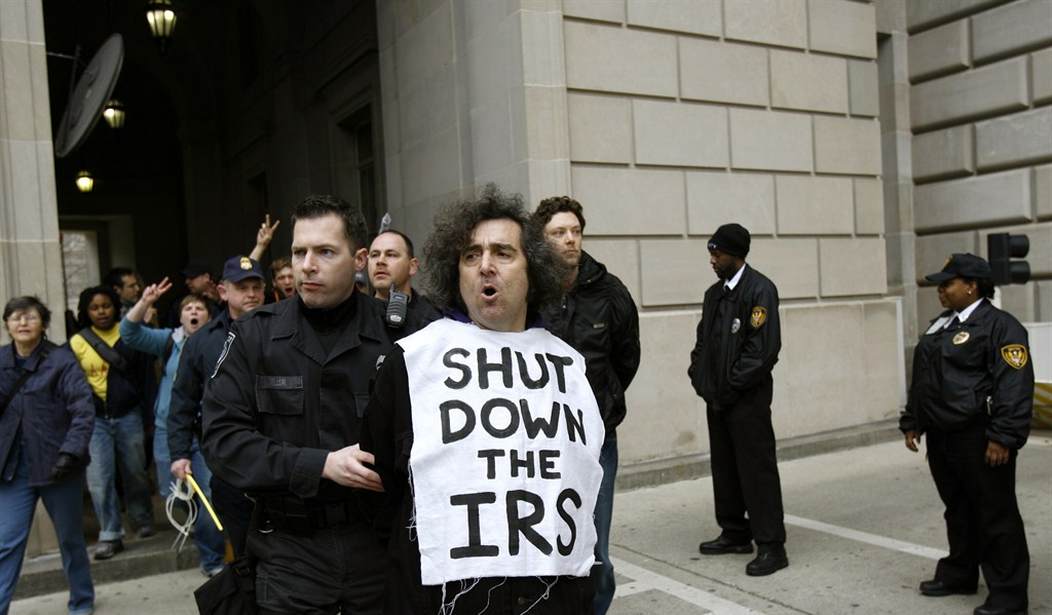

What is clear, however, is that welfare cliffs are real, and are a real problem - and on tax day, it's important to highlight the problem of welfare cliffs, and that policymakers need to be thinking of them as they design new policies.

Join the conversation as a VIP Member