WASHINGTON -- The definition of a failed, spend-thrift, debt-producing, fiscal policy is making the same proposals over and over again and expecting a different result.

In some circles, it's also the definition of crazy.

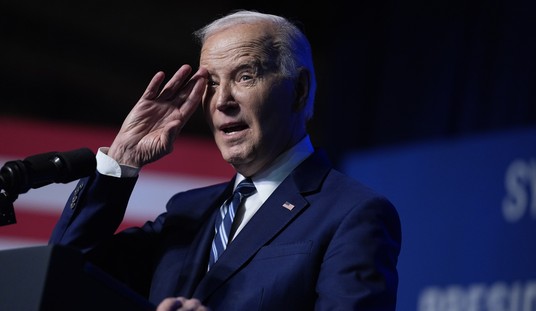

This is what President Obama has been doing over the past four years, with little to show for it, and what he intends to do over the next four years of his second term.

Obama's 2009 "shovel-ready" job stimulus plan ended up spending about $1 trillion in public funds on research, roads, bridges, education, dubious clean energy projects and a lengthy list of other federal, state and local programs around the country.

Government grew bigger, economic growth shrank, the federal debt mushroomed, and Obama presided over the slowest so-called "recovery" since the Great Depression.

Four years later, he's still proposing that we spend more public money on research, roads, bridges and education and dump more tax dollars into politically connected green energy projects -- many of which have gone bankrupt.

It should be clear to everyone that Obama's economic stimulus spending plan has been a tragic failure. Doing more of the same, as White House advisers revealed he would just before his State of the Union address, isn't going to produce a different result.

Let's recap just where we are right now after the past four years:

The Commerce Department says the economy stopped growing in the fourth quarter of 2012. The Congressional Budget Office forecasts the economy will grow very slowly this year and next, maybe in the 1 percent range, creating relatively few jobs. Unemployment rose to nearly 8 percent in January, according to the Labor Department. The CBO says the jobless rate will remain in this range for the rest of this year, at least, under existing policies.

Recommended

Nobel Prize economist and New York Times columnist Paul Krugman, one of Obama's earliest supporters, had this to say about the economy in 2012: "Things are not O.K. -- not remotely O.K. This is still a terrible economy, and policy makers should be doing much more than they are to make it better."

Krugman is not among those in the White House and the national news media who are peddling the idea that the economy is back and we are out of the woods. Not at all. Last week's Washington Post paperback best-seller list included his book, "End This Depression Now!"

Do you get the picture? The American people do. A Pew Research Center poll near the end of January reported that Americans were far more worried about the economy than any other issue.

The economy, jobs and the budget deficit were the top three concerns most frequently cited by the voters -- all issues Obama stopped talking about after his narrow re-election. The issues he has been focusing on -- gun control, illegal immigration and global warming -- were 17th, 18th and 21st on the nation's worry list, Pew said.

One of the top issues that concerns most Americans is the uncontrolled government spending that has produced four straight years of trillion-dollar deficits, and that will be near that level, if not higher, this year, according to the CBO.

But any long-term solution to the government's mounting public debt (owed to outside lenders), which will reach $12 trillion by the end of 2013, has run into a budget sequester that menacingly looms over our economy.

This sequester, which was part of the agreement in the 2011 fight over raising the debt limit, calls for automatic, across-the-board spending cuts of $1.2 trillion, if Congress and the White House cannot reach agreement on a debt-reducing plan.

The deadline to do that is March 1.

The problem is that Obama wants any budget package to include $600 billion in new tax increases. Republicans think that would be fiscally crazy at a time when economic growth has screeched to a halt; good-paying, full-time jobs are an endangered species; and millions of Americans are struggling to make ends meet.

But Obama foolishly insists you can still take a lot more money from upper-income Americans, businesses and investors without hurting economic growth. The CBO's budget analysts and most economists say that is just plain wrong -- higher taxes will lead to slower growth and less job creation as well.

Republican House Majority Leader Eric Cantor says we need more tax revenue, but that the way to get it is not to hike federal tax rates, but to increase the number of taxpayers.

That means tax incentives to boost economic expansion through increased capital investment in existing and new businesses, which will accelerate economic growth and get more people working and paying taxes.

You rarely hear the words "economic growth" from the president because he does not understand what produces it. He sees the economy as an ATM machine from which he can endlessly withdraw all the money he wants, but he does not know how to replenish it.

He talks every now and then about his Simpson-Bowles deficit-reduction commission's tax reforms, but only about its first step: ending income exemptions, deductions and loopholes. He ignores step two: using part of the additional revenue flow to lower tax rates to spur stronger economic growth and even more revenue.

While putting millions more Americans back to work will significantly reduce the deficit, a sustained, simultaneous plan to slow federal spending growth can finish the job and lead to a balanced budget. Here are a few suggestions:

-- Give the budget committees time to do their job by passing a bill to delay any sequestration until, say, the end of June. The bill should mandate a specific budget-cutting goal -- say, $2 trillion over 10 years, for starters -- but it must include tax reforms that boost revenues and lower rates.

-- Companion legislation to toughen Congress' budget process, including ironclad deadlines, plus provisions that each budget must reduce net spending each year by a set percentage until a balanced budget is secured.

-- If Congress does not does not meet the objectives of the four-month delay, then the sequester immediately kicks back in.

Can it be done? Only if lawmakers summon the will to act and if American taxpayers can make them feel the heat of an angry electorate that wants its government to live within its means.

Join the conversation as a VIP Member