It was a rebound, but it told us nothing about the underlying strength or appetite to own stocks in the middle of coronavirus angst. Market breadth was more impressive than the sloppy close of the Dow and S&P.

NYSE

- Advancers 1,907

- Decliners 1,024

- Up Volume 2.31 billion

- Down Volume 1.38 billion

NASDAQ

- Advancers 2,051

- Decliners 1.163

- Up Volume 1.61 billion

- Down Volume 805 million

Most sectors were higher, but Energy struggled from the opening bell, as crude oil continued to slide and Exxon Mobile (XOM), which laid an egg on Friday, caught a “sell” rating from an influential firm.

S&P 500 Index | +0.73% | |

Communication Services (XLC) | +1.19% | |

Consumer Discretionary (XLY) | +0.71% | |

Consumer Staples (XLP) | 0.00% | |

Energy (XLE) | -1.31% | |

Financials (XLF) | +0.70% | |

Health Care (XLV) | +0.91% | |

Industrials (XLI) | -0.04% | |

Materials (XLB) | +2.10% | |

Real Estate (XLRE) | +0.10% | |

Technology (XLK) | +1.32% | |

Utilities (XLU) | ` |

Material

The best performing sector was Materials, which rallied more than two percent on the day, but it’s been a tough road for the sector.

- 2020 -4%

- 52 weeks +10%

- 3 years +13%

It was a mix of names powering the sector, including Corteva (CTVA), which has been on fire since last Friday. The company is an interesting proxy for global agriculture and a name we will be watching a lot closer. And while the name is new, the company’s roots go back to 1802 and the founding of DuPont, and in 1897, the founding of Dow Chemical.

Other material names in the top ten S&P movers were International Flavor and Fragrance (IFFT), Martin Marietta Materials (MML) and Sherwin Williams (SHW).

Recommended

While the market grapples with coronavirus, I’m very relieved with the strong bounce in the national manufacturing data and continued signs of a housing renaissance. Overall construction data was essentially unchanged month to month in December, but it was up 5.0% from a year ago.

It was residential construction that caught my attention coming in at $548,077,000 +1.4% month to month and +5.8% from a year ago.

Portfolio Approach

Our cash level is at 2 after issuing an alert to take 30% profit in ZM (we held it a much shorter time period than planned and would spy for reentry on pullback, but that was too much to pass up).

Today’s Session

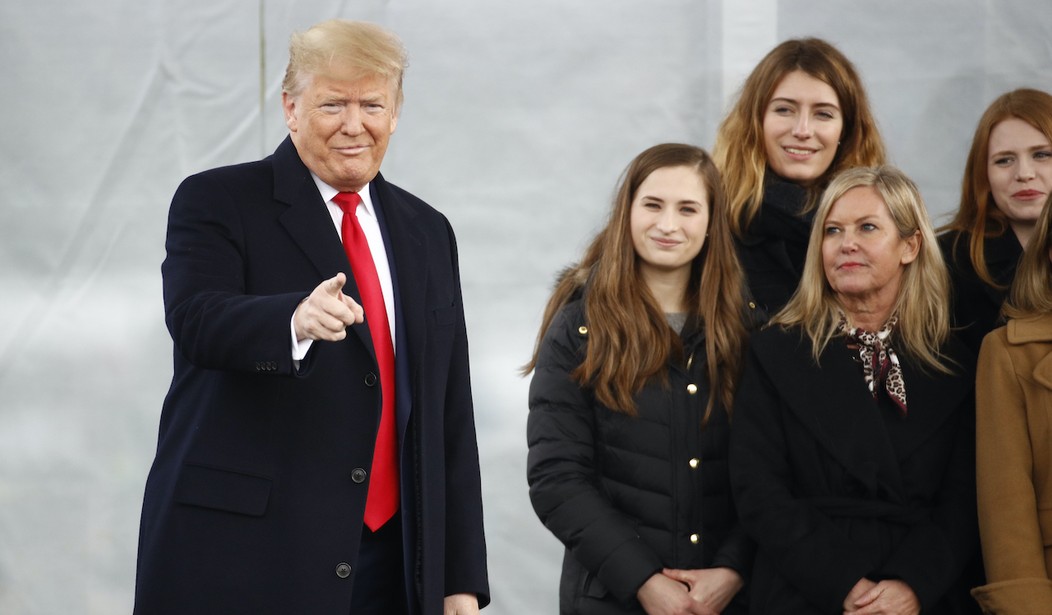

It’s the State of the Union versus the State of Chaos, as President Trump will tout his successes tonight while Democrats hash out the winner of the Iowa caucus.

I must admit, I’m surprised how much the market is up ahead of the opening bell, but I’ll take it.

Join the conversation as a VIP Member