Why do statists support higher tax rates?

The most obvious answer is greed. In other words, leftists want more tax money since they personally benefit when there’s a larger burden of government spending. And the greed can take many forms.

They may want bigger government because they’re welfare recipients getting handouts.

They may want bigger government because they are overpaid bureaucrats administering ever-growing programs.

They may want bigger government because they are overpaid bureaucrats administering ever-growing programs.

They may want bigger government because they’re lobbyists manipulating the system and it’s good to have more loot circulating.

Recommended

They may want bigger government because they’re one of the manyinterest groups feeding at the federal trough.

Or they may want bigger government because they are politicians seeking to buy votes.

But greed isn’t the only answer.

Some statists want higher tax rates for reasons of spite and envy.

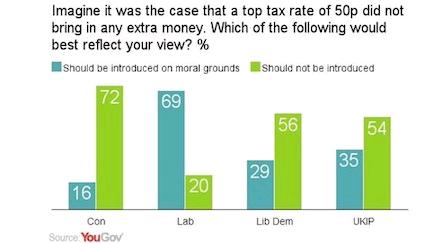

Consider this poll from the United Kingdom. It shows that an overwhelming majority of Labour voters want higher tax rates even if the government doesn’t collect any money.

These numbers are remarkable. It’s not just that the Labour Party is filled with people who want to punish success, I’m also dismayed to see that 16 percent of Tory voters and 35 percent of UKIP voters also want class-warfare tax hikes solely as an instrument of envy (though, given the mentality of some of their leaders, I’m pleasantly surprised that “only” 29 percent of Lib Dems are motivated by spite).

What about Americans? Do they have the same mentality?

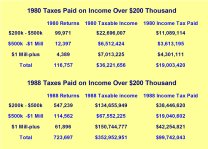

We don’t have identical polling data, so it’s hard to say.  But it would be very interesting to show leftists the IRS data from the 1980s, which unambiguously demonstrates that rich people paid more tax after Reagan dramatically lowered the top rate, and then see how they would answer the same question.

But it would be very interesting to show leftists the IRS data from the 1980s, which unambiguously demonstrates that rich people paid more tax after Reagan dramatically lowered the top rate, and then see how they would answer the same question.

If they’re motivated by greed, they would favor Reagan’s tax cuts. But if they’re motivated by envy, like leftists in the United Kingdom, they’ll be against Reagan’s lower tax rates.

Unfortunately, there’s at least one prominent statist in America who has the same views as England’s Labour Party voters. Pay close attention at the 4:20 mark of this video.

Yes, you heard correctly. President Obama wants higher tax rates and class-warfare tax policy even if the government doesn’t collect any additional money.

Which means, of course, that he’s willing to undermine American competitiveness and reduce economic output solely to penalize entrepreneurs, investors, small business owners, and other “rich” taxpayers.

Remarkable.

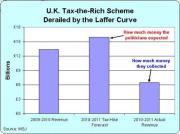

P.S. By the way, the poll of UK voters wasn’t merely a theoretical question.  The previous Labour Party government raised the top tax rate from 40 percent to 50 percent near the end of last decade and there’s very strong evidence that this tax hike failed to raise any revenue. In all likelihood, the then-Prime Minister, Gordon Brown, imposed the class-warfare policy in hopes of gaining votes in the upcoming election.

The previous Labour Party government raised the top tax rate from 40 percent to 50 percent near the end of last decade and there’s very strong evidence that this tax hike failed to raise any revenue. In all likelihood, the then-Prime Minister, Gordon Brown, imposed the class-warfare policy in hopes of gaining votes in the upcoming election.

P.P.S. Notwithstanding their many flaws, at least the folks who work for left-leaning international bureaucracies acknowledge the Laffer Curve and generally argue against pushing tax rates above the revenue-maximizing level.

- Such as the warning from the European Commission that French tax rates were reaching a “fatal” level.

- Or this study from the OECD acknowledging that lower tax rates can lead to more taxable income.

- Or this study by the IMF, which not only acknowledges the Laffer Curve, but even suggests that the turbo-charged version exists.

- Or this European Central Bank study showing substantial Laffer-Curve effects.

- Or the United Nations admitting that the Laffer Curve limits the feasible amount of taxes that can be imposed.

Since it takes a lot to be to the left of the United Nations, that gives you an idea of where Obama (and UK Labour Party voters) are on the ideological spectrum. Which is why I made the tongue-in-cheek suggestion that Birthers accuse Obama of being born in Denmark rather than Kenya.