I’m very concerned about both the fiscal cliff and its possible replacements. It will be bad news if we get an automatic tax hike on January 1, and it will be bad news if that tax increase is replaced by an even more odious plan concocted by the White House.

But the cliff is not our biggest fiscal problem.

Here’s some of what I wrote for today’s New York Post about the fiscal cliff, along with a warning that we have a much bigger problem down the road.

…it’s a fight that has important implications, particularly since some of the tax increases will have a significantly harmful impact on incentives to work, save, invest and create jobs. In a competitive global economy, for instance, it is bizarrely self-destructive to increase the double taxation of dividends and capital gains. …This is all bad news, but it is not a crisis. If we go over the cliff, it simply means the economy will grow a bit slower and politicians will spend a bit more money. And the sequester actually would be (modest) good news, since it means the burden of government spending would be “only” $2 trillion higher 10 years from now, rather than $2.1 trillion higher. And even if Obama prevails in the fight, that simply means that we get a different mix of tax hikes and spending rises at a faster rate. Sure, that’s bad for the economy, but it’s not the end of the world. The real crisis is the ticking time bomb of entitlement programs and the welfare state. This bomb won’t explode this year or next year. It may not even explode for another 20 years. But at some point America will experience a Greek-style fiscal collapse if these programs are not reformed.

Just how bad is this future problem? Gee, I’m glad you ask.

Recommended

A lot of people get upset about the national debt, which is somewhere between $11 trillion and $16 trillion, depending on whether you include money the government owes itself. Those are big numbers — but if you add up the amount of money that the government is promising to spend for entitlement programs in the future and compare that figure to the amount of revenue that the government projects it will collect for those programs, the cumulative shortfall is more than $100 trillion. And that’s after adjusting for inflation. Some politicians claim this huge, baked-into-the-cake expansion of government isn’t a problem, because we can raise taxes. But that’s exactly what Europe’s welfare states tried — and it didn’t work. Simply stated, even huge tax hikes won’t stem the flow of red ink in the long run if government keeps growing faster than the private economy. This is the fiscal problem that demands attention. Absent real entitlement reform, such as block-granting Medicaid to the states, the burden of government spending will consume ever-larger shares of our economic output with each passing year.

In other words, the solution is to follow Mitchell’s Golden Rule. That’s the only way to make sure that the burden of government spending shrinks relative to economic output.

Fortunately, that simply requires some modest spending restraint to address the short run problem and some intelligently designed entitlement reform to solve the long run challenge.

P.S. If my only choice is surrendering to Obama or going over the fiscal cliff, I’ll take the plunge without a second’s hesitation. At least we get the sequester if we go off the cliff, so there’s a tiny bit of spending restraint. Moreover, if the GOP capitulates to Obama on this fight, it will set the stage for additional bad policy over the next two years (much as the acquiescence to Obama during the March 2011 “government shutdown” fight was a sign of things to come for the last years, but at least we resuscitated two good cartoons and got some good jokes out of that debacle).

P.P.S. In addition to the Ramirez cartoon above, you can enjoy this bunch of amusing fiscal cliff cartoons. Or I should say they’re amusing so long as you don’t think about the implications.

White House Agrees with Me, Admits Tax Revenues Will Climb above Long-Run Average Even if All Tax Cuts Are Made Permanent

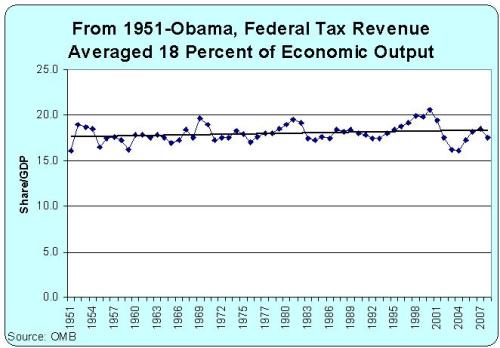

Earlier this year, I explained that tax revenues would soon climb above their long-run average of 18 percent of GDP, even if the 2001 and 2003 tax cuts were made permanent. In other words, the nation’s fiscal challenge is entirely the result of a rising burden of government spending.

Even though the data on tax revenue comes from the left-leaning Congressional Budget Office (yes, the same folks who seem to think you maximize growth with 100 percent tax rates), many folks on the left simply refuse to believe the numbers. In their minds, it is a religious tenet that red ink is the result of “tax cuts for the rich.”

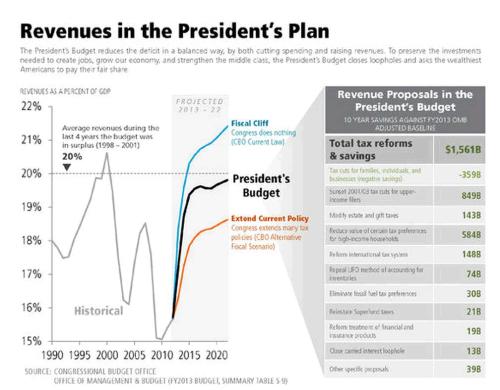

So I wonder what they will think of this chart, produced by the White House, that shows tax revenues will…drum roll please…rise above 18 percent of GDP even if lawmakers decide to “extend current policy.”

Apologies for the poor quality of the chart, by the way. It was sent out in an email by the White House and posted on the TaxProf Blog. It’s the best copy I can find.

But you don’t need 20-20 vision to see that tax revenues will get to about 18.5 percent of GDP 10 years from now if current tax policy is made permanent.

Here’s a chart I made. It’s not as fancy, but it shows tax revenue for the last 50 years of the 20th Century, plus the years leading up to Obama this century. The average is exactly 18.0 percent, with a slight upward trajectory according to the Excel auto-trendline feature.

The moral of the story is that the tax increase battle is not about deficits and debt. The President’s class-warfare tax policy is designed to enable bigger government.

In the short run, the tax increase will help lock in place the expansion of government that took place during the Bush-Obama years.

In the long run, though, the left will want even more taxes to enable the demography-drive expansion of the welfare state. Higher revenues, in other words, are a substitute for real entitlement reform.

What the left generally won’t admit, however, is that the rich are not a piñata, capable of disgorging limitless amounts of new money. There are big Laffer-Curve effects when tax rates climb too high, largely because upper-income taxpayers have considerable control over the timing, level, and composition of their income.

So the ultimate target will be the middle class, as more and more statists are admitting, and the most worrisome threat is the value-added tax.

P.S. You may have noticed that the White House used 20 percent of GDP as a benchmark in its chart, apparently because we should strive for the fiscal policy we had in Bill Clinton’s second term. I might be willing to take them up on that offer, so long as they’re also willing to accept Bill Clinton’s spending levels.