It's been roughly one month since I added shares of Celsion (Nasdaq: CLSN) to my $100,000 Real-Money Portfolio, and they're already up nearly 25%.

In fact, this stock has more than tripled from its 52-week low, and for some early investors who have already seen a huge move, the thought of booking profits must be quite tempting.

But that would be a mistake.

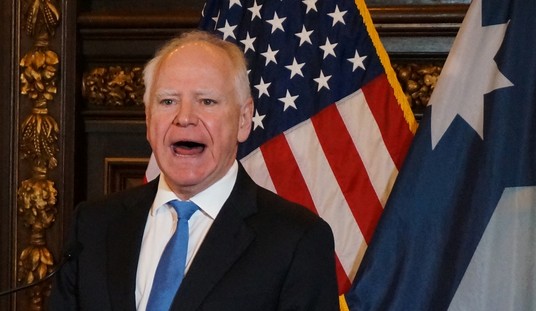

Take a look at this stock's impressive run in the past month...

.png)

Recommended

Management's moves in the next few months are crucial in establishing the kind of value this company deserves, so exiting this stock now would be quite premature.

In a moment, I'll explain the catalysts ahead for this surging biotech, but first, let's address a key near-term headwind.

On Aug. 13, a few days before I added Celsion to my portfolio, the company filed a $75 million "fixed shelf offering. "This means the company now has the authorization to raise that much money in the form of new stock, debt, or some combination of both. Yet investors hate to see this kind of financial action. Just look at what happened to shares of biotech firm Pluristem (Nasdaq: PSTI) when the company announced it was selling shares to raise more money.

.png)

That's why you need to brace for a hiccup in Celsion if the company makes a similar announcement. The fact that shares are moving up quickly means management may be tempted to "strike while the iron is hot."

To put things in context, Celsion currently has 33.24 million shares outstanding. If the company had proceeded with a capital raise back in August (with shares trading at $3.28), then that would have swelled the share count by 22.9 million shares, in effect diluting existing shareholders by 70%. Now with shares approaching $5.50, a $75 million capital raise would lead to the issuance of 13.6 million new shares, or roughly 40% dilution.

To put things in context, Celsion currently has 33.24 million shares outstanding. If the company had proceeded with a capital raise back in August (with shares trading at $3.28), then that would have swelled the share count by 22.9 million shares, in effect diluting existing shareholders by 70%. Now with shares approaching $5.50, a $75 million capital raise would lead to the issuance of 13.6 million new shares, or roughly 40% dilution.

This still counts as a worst-case scenario. In fact, there's a very good chance Celsion will try to borrow money instead. That's what the company did back in June, leading Financial Officer Greg Weaver to note the following on a mid-August conference call: "This management team continues to focus on cost controls and make our cash work as hard as possible and the virtually nondilutive loan proceeds provided additional strength to the balance sheet as we approach year-end."

To be sure, the longer Celsion waits, the better the negotiating position will be. Right now, the company is making presentations at several international oncology conferences. That helps explain why shares are on the move right now. Sometime in the fourth quarter, Celsion will have completed its all-important Phase III clinical trials for its cancer-fighting treatment ThermoDox. Soon thereafter, the company is expected to publicly release that data, which could then pave the way for a rapid review by the U.S. Food and Drug Administration. A marketing or licensing partner? That could come by the first quarter of 2013 -- if not sooner.

Risks to Consider: As is the case with any biotech stock, there are myriad risks, from an FDA rejection to slow uptake by the medical community. Precisely gauging the potential opportunities for Celsion's ThermoDox is still a challenge, and we won't get a clear read on that actual revenue and profit road map for this company for many more quarters to come.

Action to Take --> Celsion continues to face a compelling market opportunity, especially in the area of liver cancer, which is increasingly prevalent throughout Asia. Even if this company dilutes current shareholders with a 40% expansion in the share count, then you're still looking at a $300 million market value, which is well below the ultimate potential market size for the company's ThermoDox technology.