One of Barack Obama's favorite words has sparked an unlikely kerfuffle within Democratic ranks. During the 2008 campaign, candidate Obama told a debate audience that actual revenue outcomes aren't as important as imposing "fairness" through policy. Even if raising a given tax reduces the amount of money the federal government takes in, he said, it's worth it, "for purposes of fairness." Sure enough, as president, Obama remains wedded to the same destructive mentality. He's made this subjective concept a centerpiece of his re-election campaign, touting the so-called "Buffett Rule" as the crown jewel of this egalitarian vision. But there's trouble in paradise -- a Democratic group is splitting with the White House over this core priority, arguing that it won't win the hearts and minds of independent voters:

As President Obama and other Democrats ramp up for a Senate vote next week on the so-called Buffett rule, the centrist Democratic think tank Third Way is rudely interrupting the unity-fest with a warning that this is the wrong way to lock down wavering independents in swing states. These crucial voters prefer hearing candidates talk about opportunity, the group said.

Just a tad off message, but perhaps an inconvenient truth. The Third Way analysis stems from a poll of 1,000 independents in 12 battleground states. It found that 38 percent of them didn't have strong opinions about Obama or likely GOP nominee Mitt Romney. Most of this up-for-grabs group views Obama favorably, but places itself much closer to Romney on the ideological spectrum. And - alarm bells here for Team Obama and the Democrats - most of them do not think American society is unfair.

The swing independents, in fact, are divided on the meaning of fairness. A plurality said making the wealthy pay more in taxes would be most fair, but nearly as many said it would be most fair to make everyone pay the same tax rate no matter what they earn. More than a quarter said it would be most fair to make everyone pay some taxes, regardless of how little they earn.

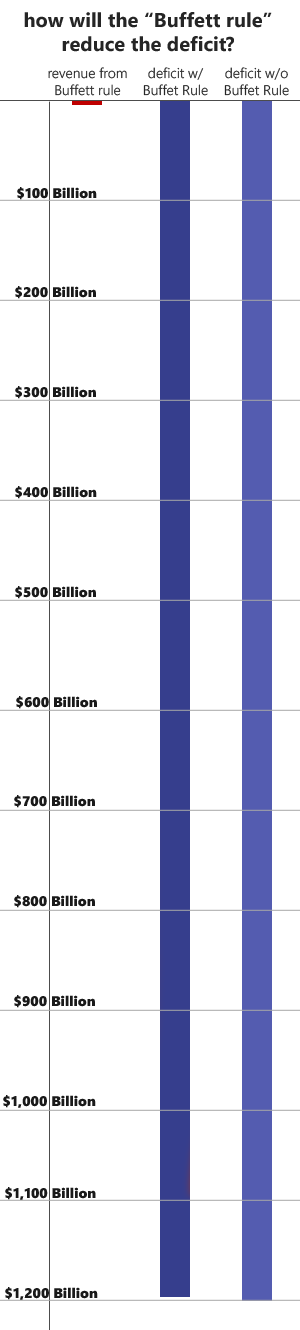

As we've noted before, the president's idea of fairness is wildly out-of-step with that of most Americans. He wants to raise the effective top marginal tax rate to nearly 45 percent. A huge majority of voters think 30 percent of earned income -- lower than the prevailing top rate -- is the largest chunk the federal government should demand from any citizen. In his terrible speech on Paul Ryan's budget last week, the president insisted that we have to "get serious" about the deficit. Bear in mind that this is a leader who has racked up trillion-plus dollar deficits every single year of his presidency, despite a pledge to cut the annual deficit in half by now, and whose policies have added well over $4 Trillion to the national debt -- a transgression he labeled "unpatriotic" when his precedessor reached the same ugly milestone after eight full years in office. And how does the Buffett Rule "get serious" about our deficit? By maybe collecting around $30 Billion...over 11 years:

A bill designed to enact President Barack Obama’s plan for a “Buffett rule” tax on people earning more than $1 million a year would rake in just $31 billion over the next 11 years, according to an estimate by Congress’ official tax analysts obtained by The Associated Press. That would be a drop in the bucket of the over $7 trillion in federal budget deficits projected during that period.

Political Math puts these numbers into perspective. Gettin' serious, Obama-style:

The president has been claiming this stunt would "stablize" our debt over the next decade. Confronted with all evidence to the contrary, his White House is now dialing this assertion back, arguing instead that it's sound policy because of -- you guessed it -- "fairness:"

Recommended

The Obama administration is emphasizing “fairness” over deficit reduction in its renewed pitch for the “Buffett rule” ahead of next week’s scheduled Senate vote. [It] “was never our plan to bring the deficit down and get the debt under control,” Jason Furman, the principal deputy director of the White House National Economic Council, told reporters on a conference call Monday afternoon. “This is not the president’s entire tax plan. We’re not trying to say this solves all our economic problems, all our budget problems.”

Great. Let's have a giant political fight over a meaningless piece of theater, all in the name of tax justice, or whatever. After Great Britain raised its top marginal rate to 50 percent in recent years, the resulting government revenues didn't even approach expected levels because targeted citizens moved away or moved their money. I'd point this out as an object lesson to our administration, but it's very clear that they couldn't care less about data or outcomes. They're indugling their fetish and hoping it'll muddy the waters enough to fool people into forgetting about their failed record. Parting Thought: Good news, Obama fans. The president leads Mitt Romney by seven points among registered voters, according to WaPo/ABC News. The less exciting truth? They needed a +11 Democrat sample -- with just 23 percent (!) of Republican respondents -- to concoct that aforementioned good news.

UPDATE - Phil Klein echoes my point here. It's not about the math.