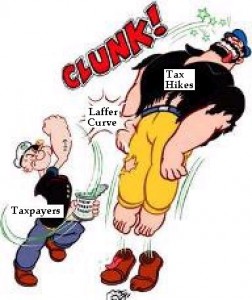

If you appreciate the common-sense notion of the Laffer Curve, you’re in for a treat. Today’s column will discuss the revelation that Francois Hollande’s class-warfare tax hikes have not raised nearly as much money as predicted.

And after the recent evidence about the failure of tax hikes in Hungary, Ireland, Detroit, Italy, Portugal, the United Kingdom, and the United States, this news from the BBC probably should be filed in the category of “least surprising story, ever.”

The French government faces a 14bn-euro black hole in its public finances after overestimating tax income for the last financial year. French President Francois Hollande has raised income tax, VAT and corporation tax since he was elected two years ago. The Court of Auditors said receipts from all three taxes amounted to an extra 16bn euros in 2013. That was a little more than half the government’s forecast of 30bn euros of extra tax income.

And why have revenues been sluggish, generating barely half as much money as the politicians wanted?  For the simple reason that Hollande and the other greedy politicians in France failed to properly anticipate that higher tax rates on work, saving, investment, and entrepreneurship woulddiscourage productive behavior and thus lead to less taxable income.

For the simple reason that Hollande and the other greedy politicians in France failed to properly anticipate that higher tax rates on work, saving, investment, and entrepreneurship woulddiscourage productive behavior and thus lead to less taxable income.

…economic growth has been inconsistent and the unemployment rate hit a record high of 11% at the end of 2013. The French economy saw zero growth in the first three months of 2014, compared with 0.2% growth three months earlier. The income tax threshold for France’s wealthiest citizens was raised to 75% last year, prompting some French citizens, including the actor Gerard Depardieu, to leave the country and seek citizenship elsewhere in Europe.

Recommended

But we do have some good news. A French politician is acknowledging the Laffer Curve!

French Prime Minister Manuel Valls, who was appointed in March following the poor showing of Mr Hollande’s Socialists in municipal elections, appeared to criticise the president’s tax policy by saying that “too much tax kills tax”.

By the way, France’s national auditor also admitted that tax hikes were no longer practical because of the Laffer Curve. Heck, taxes in France are so onerous that even the EU’s Economic Affairs Commissioner came to the conclusion that tax hikes were reducing taxable income.

Though here’s the most surprising thing that’s ever been said about the Laffer Curve.

…taxation may be so high as to defeat its object… given sufficient time to gather the fruits, a reduction of taxation will run a better chance than an increase of balancing the budget.

And I bet you’ll never guess who wrote those words. For the answer, go to the 6:37 mark of the video embedded in this post.

P.S. Just in case you’re not convinced by the aforementioned anecdotes, there is lots of empirical evidence for the Laffer Curve.

- Such as this study by economists from the University of Chicago and Federal Reserve.

- Or this study by the IMF, which not only acknowledges the Laffer Curve, but even suggests that the turbo-charged version exists.

- Or this European Central Bank study showing substantial Laffer-Curve effects.

- Or this research from the American Enterprise Institute about the Laffer Curve for the corporate income tax.

P.P.S. For other examples of the Laffer Curve in France, click here and here.

P.P.P.S. To read about taxpayers escaping France, click here and here.

P.P.P.P.S. On a completely different subject, here’s the most persuasive political ad for 2014.

I realize the ad doesn’t include much-needed promises by the candidate to rein in the burden of government, but I’m a bit biased. And in a very admirable way, so is Jack Kingston.

Join the conversation as a VIP Member